Speculators Send 35,000 BTC to Exchanges in New ‘Flow of Euphoria’

As recently reported, Bitcoin holders (bitcoin) would feel the need to sell BTC around $30,000 in the short term.

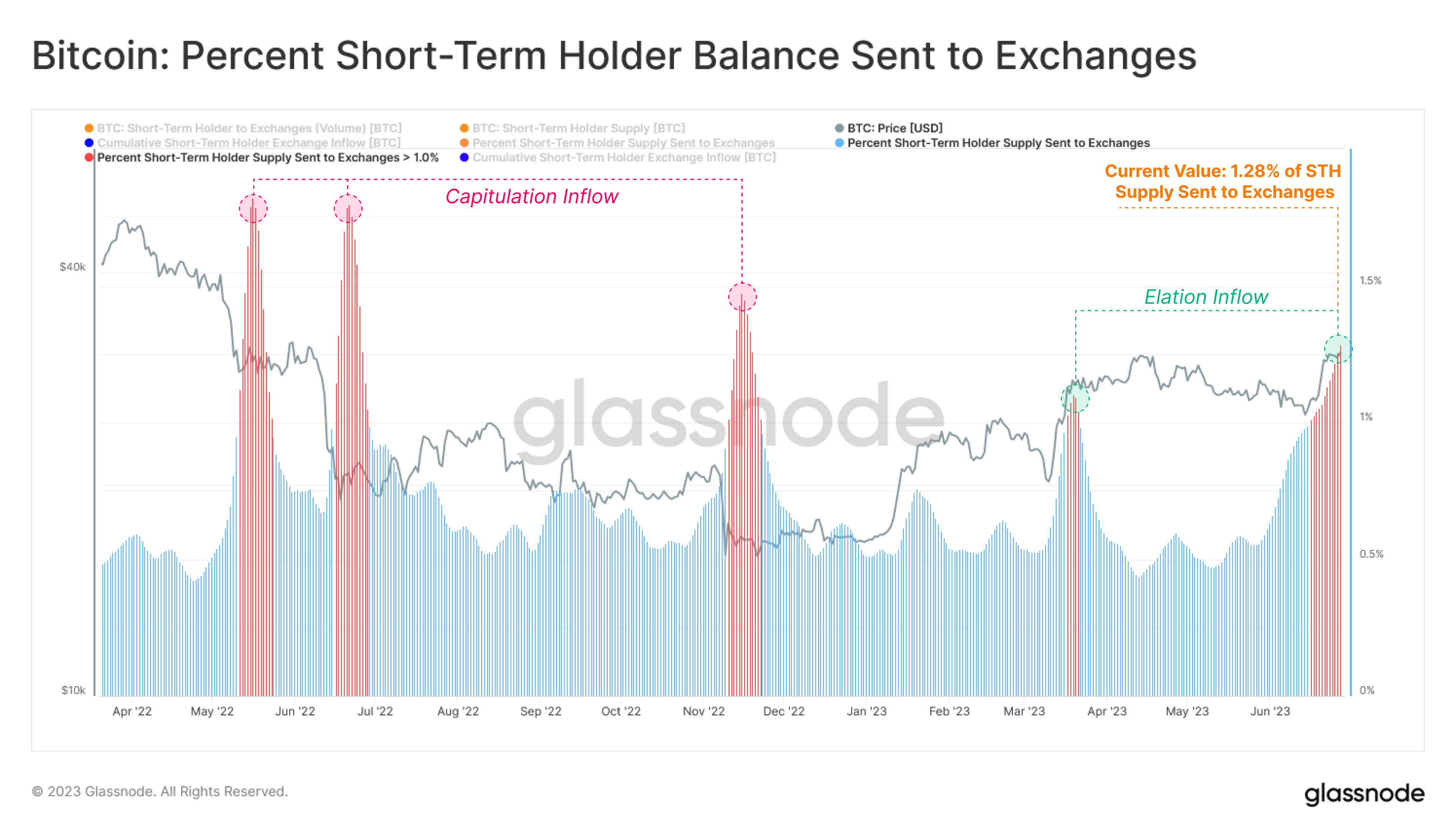

Inside research On June 28, on-chain analytics firm Glassnode reported that tens of thousands of coins were sent to exchanges.

Bitcoin speculative maneuvers on exchanges intensify

BTC’s price action, pegged at $30,000, is making profit-takers this month think twice.

Especially short-term holders (STH), i.e. organizations with capital of 155 days or less, they tend to sell more and more.

By monitoring entries into exchange wallets, Glassnode reports a net increase in funds offered for sale by STHsThose who fit into the ranks of Bitcoin’s most speculative investors.

“Bitcoin’s recent price enthusiasm has led to an increase in short-term owner interaction with exchanges”Commented on Glassnode.

“Currently inflows from STH are intensifying and a substantial supply of 1.28% (+35,400 BTC) is sent to exchanges.”

An attached chart highlights the difference between current entries and those recorded during the 2022 bear market.

STHs are more inclined to sell in bulk during periods when the BTC price is under control to limit losses. On the other hand, the profit-taking seen both today and in March when BTC/USD returned to $30,000 for the first time – led to lower trading volumes overall.

make 10% profit

The data shows that speculative interest in Bitcoin remains volatile and highly sensitive to even minor price movements.

However, STHs have assumed an important role in the 2023 market.

as evidenced by Glassnode and CointelegraphTotal cost floors – about $26,500 at the start of the month – remained intact as a support level.

Meanwhile, on-chain analysis predicts that profit-making could quickly become dominant if the price of BTC rises again.

Historical data shows that after STH profitability hits 20% overall, the sell-off phase begins and anything above $33,000, given the current breakeven point of $26,500. can trigger a significant shift in the distribution of holders.

THEM current data It shows an STH profitability of around 10% which is currently over $27,000 with the fulfillment price being the last price STH coins moved.

This article does not contain investment advice or advice. Every investment and trade involves risk and readers should do their own research before making a decision.

Translation of Walter Rizzo