Profit taking follows 2021

According to a new analysis, Bitcoin (Bitcoin) would witness a massive profit taking, rivaling the all-time high of $69,000.

Inside today’s postJames Van Straten, research and data analyst at crypto analysis firm CryptoSlate, reported that billions of dollars are flowing into crypto exchanges.

Bitcoin speculators are selling like we’re back to all-time highs

BTC’s price increases in recent days have greatly rewarded its holders. Outlook at 19-month highs.

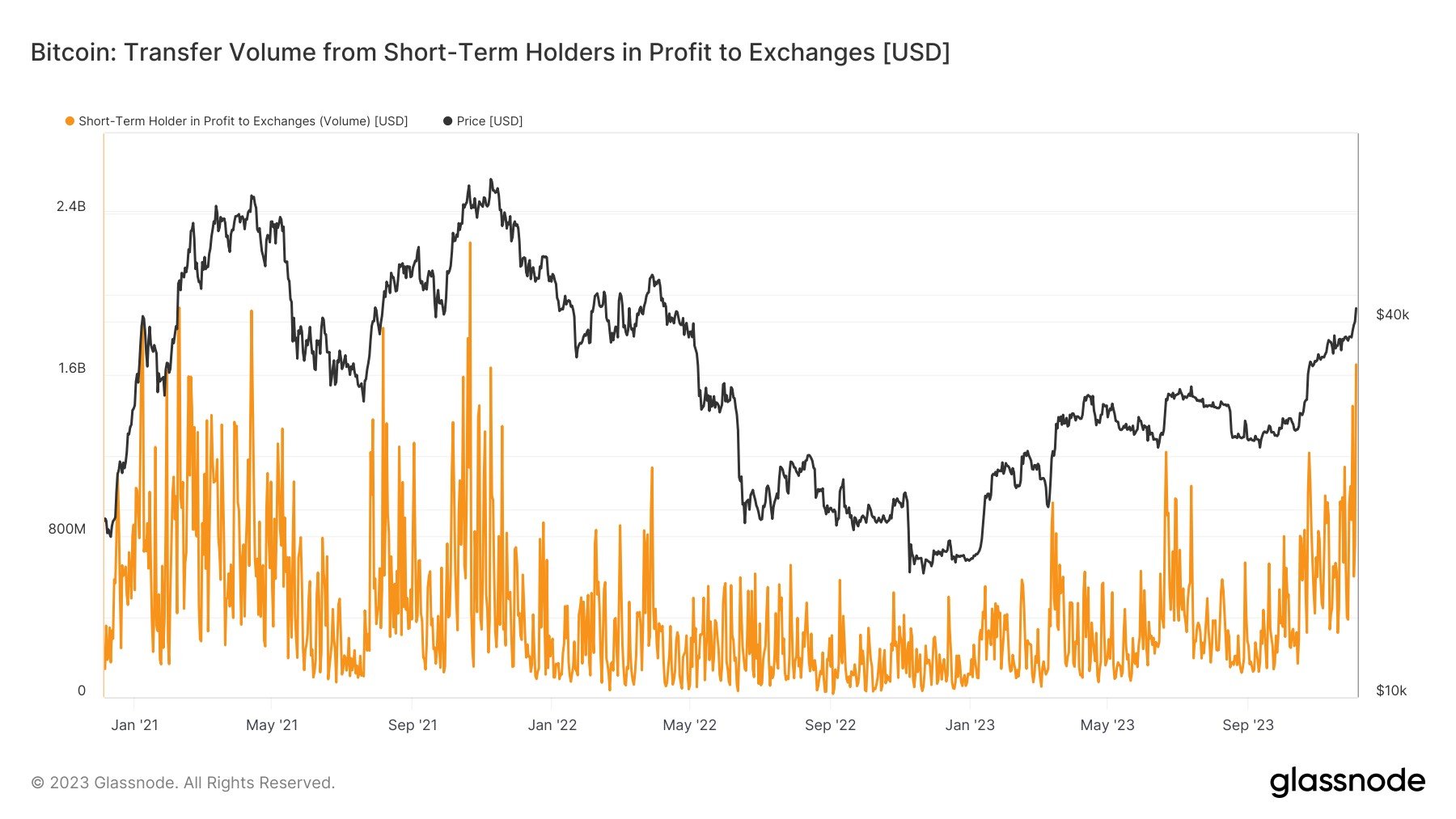

While former holders maintain their share of the BTC supply, at the other end of the spectrum, so-called short-term holders (STH) are busy making profits from their investments.

STHs refer to individuals who hold a certain portion of the supply for 155 days or less. They correspond to the most speculative class of Bitcoin investors, and their cost base has been a significant support of the BTC price in 2023.

Data shows that BTC/USD has gained almost 15% in value in a week and it is now time to re-evaluate its risks.

According to Van Straten, the total transfer volume between STHs and exchanges (that is, coins prepared for sale) approached 5 billion dollars in the last four days.

“Bitcoin gained 7% and reached a yearly high of $38,800 on December 1.”commented.

“This turning point triggered the largest recent profit-taking by short-term holders since November 2021.”

Van Straten cited data from on-chain analysis firm Glassnode.

Therefore, STH’s profit taking continues to reflect its activity from two years ago, when BTC/USD reached its current record high of $69,000.

Bitcoin bull market hurdles align

As Cointelegraph reported, the recent gains have reignited predictions that a return to these levels will come sooner than many believe, thanks to a combination of domestic and macroeconomic factors.

Philip Swift, creator of the Look Into Bitcoin statistics resource, analyzed what lies ahead, highlighting the Fibonacci retracement levels recorded in previous Bitcoin bull markets.

Swift brought back the Gold Multiplier Ratio parameter it created in 2019. Watch price cycle highs.

“These lower ranges have historically served as resistance in early bull markets: x1.6 (green line) is currently at $43,739 and climbing.”have illustrated this week on X (formerly Twitter).

Swift added that the highest levels were “We have successfully set all Bitcoin cyclical all-time highs to date.”.

This article does not contain investment advice or recommendations. Every investment and trading transaction involves risk, and readers should conduct their own research before making a decision.

Translation by Walter Rizzo