Cryptocurrency trading addiction: how to recognize it?

An often overlooked aspect of cryptocurrency market volatility is the impact of sudden price changes on the mental health of traders and investors.

There day trading addiction – or pathological trading – already well known among stock and commodity traders and extensively documented by medical professionals. There are even rehabilitation programs dedicated to treating this type of addiction.

With the potential for “life-changing” earnings for those lucky or smart enough to get it, the cryptocurrency market has spawned quite a bit of trading addiction.

Cointelegraph spoke to better understand the mechanics of cryptocurrency trading addiction and how to recognize it. Tony MariniSpecialist therapist at Castle Craig Rehab in Scotland, e Aaron SternlichtCo-founder of Private Practice Family Addiction Specialist in New York.

What is Cryptocurrency Trading Addiction?

Sternlicht defines cryptocurrency trading addiction as:

“Persistent or recurrent pathological compulsion and obsession to engage in cryptocurrency trading or investment behavior despite adverse personal and/or professional consequences such as financial loss, relationship breakdown, career issues, mental health, and other repercussions.”

He believes that addiction goes far beyond just buying and selling coins. When a trader’s days are completely absorbed From chart analysis, market research, data analysis, fundamental analysis or investor sentiment, it can be a problem.

11 reasons why cryptocurrency is highly addictive and what you can do about it.https://t.co/xzx9lMw8BL#crypto #cryptocurrency #Bitcoins #BTC #Ethereum #crypto trading #moon #Soil pic.twitter.com/3IJfEkIhee

— Family Addiction Specialist (@linandaaron) 23 May 2022

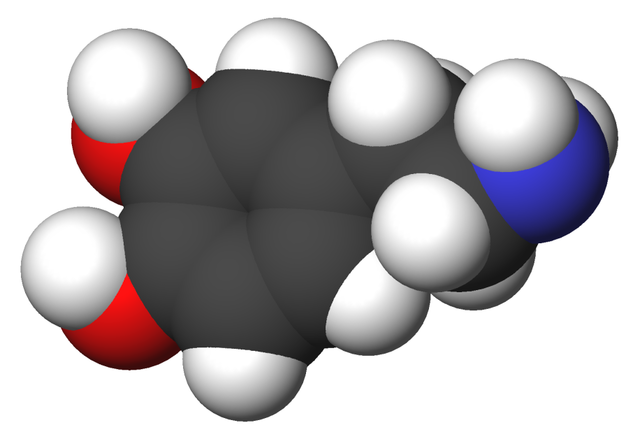

It’s all about neurotransmitters

The body produces a called neurotransmitter dopamineThe nervous system uses it to transmit messages between nerve cells. Sternlicht says that when the price of cryptocurrencies rises and someone makes a winning trade, they experience a burst of dopamine that causes a feeling of pleasure.

“The volatility of cryptocurrencies, combined with the fact that they can be traded 24/7, can cause extreme and regular dopamine surges. This makes cryptocurrencies much more interesting than other assets like stocks.” explains Sternlicht. Over time, those who develop an addiction begin to enjoy trading cryptocurrencies on their own.

dopamine molecule

Sternlicht explains that certain stimuli that release large amounts of dopamine, such as sex, drugs, video games, and social media, are more likely to be addictive. Profitable transactions also fall into this category.

In conclusion, Other natural pleasures, such as eating a great meal or watching a beautiful sunset, may become less stimulating and appealing.. “Since the brain is naturally inclined to seek pleasure, losing interest in other life experiences that it previously found satisfying, the individual is constantly affected by the stimuli of his choice.‘ says Sternlicht.

Marini points out that not everyone will become a compulsive gambler, cocaine addict, alcoholic or addicted to cryptocurrency trading; still, he believes that around 3% of the British population are gamblers. UK Health Safety Agency guessed that approximately 2.2 million adults are problem gamblers or at risk of addiction. Both Marini and Sternlicht agree on this. Cryptocurrency addiction is very similar to gambling addiction. and should be treated as such.

With 33% of the country Marini, who has joined the cryptocurrency market, fears that he is only observing the tip of the iceberg. “I noticed that more and more people who are interested in cryptocurrencies are coming,says the sea.

Since 2016, Castle Craig has registered over 200 clients with cryptocurrency addictions. Marini believes that cryptoassets attract people much faster than gambling due to their volatility:

“They were constantly monitoring prices as they were constantly fluctuating. And with over 20,000 different cryptocurrencies, they were spending a lot of time looking at cryptocurrency sites on the internet. It was having a negative impact on their lives.”

But cryptocurrencies pose no risk to most people, according to Sternlicht:

“Most people can invest and trade in cryptocurrencies without developing a pathological problem, but some individuals develop a pervasive disorder of their trading behavior that causes addiction.”

Who are at risk?

While there is no way to accurately determine who will develop an addiction to cryptocurrency trading, Sternlicht believes that those who interact with cryptocurrencies frequently, have other addictions, or have problematic gambling experiences are more susceptible. A family history of addiction, underlying mental health problems, impulsivity or risk-taking personality traits can trigger addictive behaviors.

In Sternlicht’s experience, cryptocurrency traders are generally well-educated and financially stable. They feel they have an advantage in the market and know something that others don’t.:

“For example, they may spend a lot of time researching the fundamentals of a particular project, or they may be very skilled at analyzing charts, macroeconomics, market sentiment, and other speculative metrics. This is called the ‘illusion of control’.”

In a 2014 study, researchers from the Universidad de Deusto and University College London explained:The illusion of control consists in exaggerating the weight our behavior places on uncontrollable consequences.“

According to Sternlicht, this false sense of security can encourage traders to take more risks and trade more often. If traders feel they have an advantage, they may tend to take riskier trades. and develop a trading addiction.

Marini created the “Crypto Curve,” a diagram that illustrates the lifecycle of such risky behavior. Marini’s Crypto Curve visualizes the evolution of trading addiction from “highly satisfying” and “despairing” to “fulfillment”, “recovery” and “growth”.

Marini’s Crypto Curve shows the stages of addiction and recovery

How do you know if you have a problem?

According to Sternlicht, some signs to look for are unsuccessful attempts to stop or reduce trading, thinking about cryptocurrencies all day long, the feelings of guilt and shame associated with such behavior, and hiding losses from loved ones. Lying, stealing, selling something, or borrowing money to continue trading are also strong warning signs.

A client of Marini’s worked at a financial firm and stole $1.5 million worth of BTC and lost just $1.2 million. Another client who applied to Castle Craig for his substance abuse and managed to recover from it later earned half a million euros from trading in cryptocurrencies. Two years later, the client returned to the clinic after he started using drugs and alcohol and lost all of his crypto assets.

Other signs of addiction include buying cryptocurrencies with money set aside for daily spending, prioritizing trade over relationships and career opportunities, difficulty concentrating, loss of interest in activities other than cryptocurrencies, and trouble sleeping due to trading or related activities.

treatment methods

For those seeking outpatient treatment, Sternlicht tailors the treatment to the needs of each client. While there is no one-size-fits-all approach, there is a general framework that applies to all patients. After a comprehensive evaluation by the team, personalized treatment plans are created that include therapy, coaching, psychiatry, family/couple counseling, financial audit, sleep-exercise-nutrition tracking and other daily checks. Drug and alcohol tests can also be scheduled. Sternlicht also combines meditation and holistic therapies.

Financial monitoring is an important component of Sternlicht’s approach:

“As all of our clients are addicted to cryptocurrencies, we find it helpful to set up financial monitoring systems of their assets, including bank accounts and trading platforms. Wallets are also monitored.”

Sternlicht believes that auditing assets – and sometimes even temporarily removing control – can help the client take responsibility and focus on recovery. This audit can be performed by a friend, trusted family member, financial professional or Sternlicht staff.

During a session, a client may focus on identifying triggers for addiction and creating incentives to avoid trading, building trust and setting boundaries in relationships, or working on mental health and trauma issues.

Between sessions, the team monitors sleep, nutrition, exercise and electronic device use: “Healing is like a puzzle made up of several pieces. The more pieces put together, the greater the chance of living a prosperous and successful life.“

According to Marini, Castle Craig treats cryptocurrency addiction as a form of gambling addiction. They combine cognitive behavioral therapy with a 12-step approach. The first step is to admit that there is a problem.:

“I’m powerless against this addiction and so my life has become unmanageable. So I have a problem. Then when you look inside it turns out that it’s me.”

The six-week residential program includes individual and group therapy. Marini believes group therapy is important for awareness and sharing: “In group work you identify with someone else so you no longer feel alone. Individual therapy is great, but group work is probably the most important part.“

Treatment also includes equine therapy, art therapy, and holistic practices, according to Marini. Recovery also focuses on avoiding post-treatment relapses and multiple substance addictions.. For example, Marini suggests that due to the volatility and 24/7 nature of cryptocurrencies, some may turn to amphetamines to help them stay awake longer.

Welcome back to the beautiful donkeys!#atlatherapy #castlecraig pic.twitter.com/Jd16prPTux

– Castle Craig Rehab (@CastleCraig) 21 May 2022

Ultimately, Marini believes, healing is about finding yourself and understanding what addiction is and why it causes certain behaviors:It’s about finding yourself. Great. We do this very often.“

Translation of Giorgio Libutti

Mitch Seven He is a writer who covers cryptocurrencies, politics and the intersection of these two things, as well as a handful of unrelated topics. He believes cryptocurrencies are the future of finance and is grateful to have the opportunity to talk about it.