Tether partner Bank Britannia sued over $1 billion in deposits

Tether’s banking partner Britannia Financial is reportedly facing a lawsuit for failing to pay the full price of income-generating assets allegedly tied to a large Tether deposit.

According to what was reported by Finance Times Earlier today, it was reported that Arbitral International, a company registered in the British Virgin Islands, had sued Britannia over a $1 billion deposit from Tether, according to court documents filed in the High Court of Justice in London in 2023.

The case relates to Britannia’s acquisition of Arbitral’s Bahamas-based brokerage business known as Arbitral Securities. There is in Britain announced The October 2021 acquisition integrates the brokerage business into its brokerage firm, Britannia Securities.

According to the new report, Britannia and Arbitral agreed that one year after the sale, Britannia Financial would pay an additional amount based on the number of income-producing assets held by Arbitral Securities. The agreement reportedly stipulates that this will include customers initially introduced by Arbitral or related parties.

Citing court documents, the report claims that Tether opened an account with a subsidiary of Britannia Financial in November 2021.

Britannia Financial was reportedly promoted to Tether by Aldo Mazzella, who is described as a “professional promoter” and is believed to have had a business relationship with Tether since approximately 2017. On the other hand, Arbitral claimed that an executive from Arbitral Securities also played a role in the Britannia-Tether partnership.

The news comes a few months after Bloomberg reported that Tether had added Britannia Bank and Trust, a private bank based in the Bahamas, to process dollar transfers on its platform. Other banking partners will be Deltec Bank and Capital Union Bank.

Tether’s chief technology officer and new CEO, Paolo Ardoinowould be stated Previously, the stablecoin company had strong relationships with more than seven banks.

Tether and Britannia Financial have not yet responded to Cointelegraph’s request for comment.

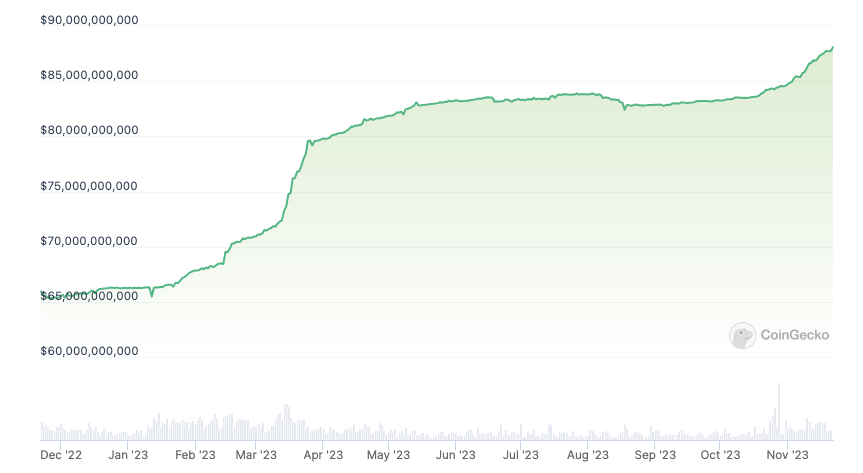

Tether stablecoin (USDTAccording to data, it has steadily gained momentum in the market and is on track to reach a market value of $90 billion. CoinGecko. On November 20, the value of USDT reached $88 billion, an increase of 33% since the beginning of 2023.

According to Tether, USDT has increased its market value by more than $20 billion in 2023 thanks to two key factors, including ongoing market enthusiasm over the possible approval of a spot Bitcoin exchange-traded fund. Tether’s record-breaking growth is also driven by rising demand in emerging markets like Brazil, according to the company.

Translation by Walter Rizzo