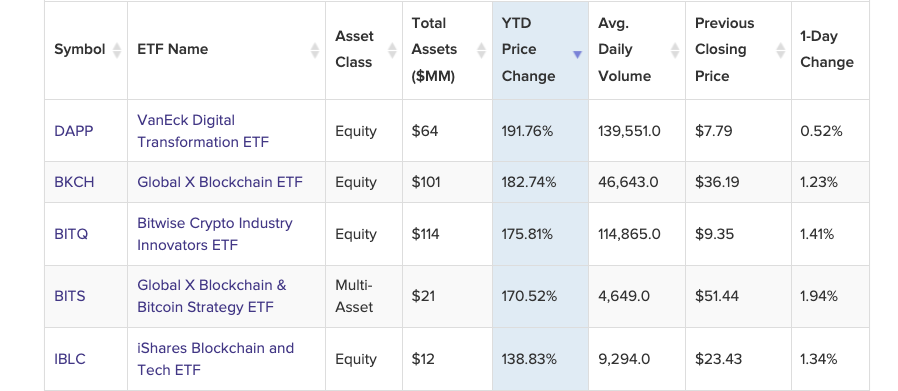

Here are 5 blockchain ETFs with more than 100% returns in 2023

The crypto community is focused on the potential approval of one or more spot ETFs (exchange-traded funds) in Bitcoin (Bitcoin) Some cryptocurrency-related ETFs in the United States have already posted significant gains this year.

One of these is the VanEck Digital Transformation ETF (DAPP), which is up almost 207% year-to-date (YTD), according to its data. Trading View. Launched in April 2021, DAPP tracks the price and performance of the MVIS Global Digital Assets Equity Index, which is based on the performance of major companies in the digital asset economy.

VanEck’s DAPP ETF’s main asset exposures include Coinbase (COIN), MicroStrategy (MSTR) and Block (SQ). Coinbase and MicroStrategy have seen significant growth, increasing respectively this year 312% he was born 302% On an annual basis, according to TradingView data.

At the time of this writing, DAPP is the best-performing blockchain ETF so far in 2023, outperforming ETFs like Global. VettaFi.

According to TradingView, BKCH Spherical BITQ Bitwise has returned almost 192% in 2023. VettaFi’s performance data differs significantly from TradingView’s, lagging by 50% in some cases.

Other winners of the list of best-performing blockchain ETFs of 2023 include Global Trading View there are both augmented Their value has increased by over 184% since the beginning of the year.

Despite the massive returns recorded in 2023, some blockchain ETFs are still far from all-time highs. For example, the VanEck Digital Transformation ETF is down nearly 77% from the record high of $34 set in November 2021. At the same time, the iShares Blockchain and Tech ETF broke all-time highs as the stock reached its previous high. In November 2023, it was $8.4.

Related: SEC Delays Invesco Galaxy Spot Ethereum ETF Decision to 2024

As it is known, there are many companies that have achieved success with blockchain ETFs in 2023, including VanEck, Bitwise and Global. Spot Bitcoin ETF.

Unlike blockchain-themed ETFs like DAPP and BKCH, the Bitcoin spot ETF seeks direct exposure to the Bitcoin price by holding the actual cryptocurrency.

VanEck filed its fifth amended application on December 8 seeking approval of its spot ETF by the U.S. Securities and Exchange Commission (SEC). According to Bitwise, Spot ETF to be approved in 2024 and will create “The most successful ETF launch of all time”.

Translation by Walter Rizzo