Fault in Fed payment system prevents Americans from receiving payments

Following an outage of one of the Federal Reserve’s payment systems on November 3, some major US banks were unable to process customer deposits.

of the Federal Reserve declaration The error was stated to be due to a “processing issue” at Automated Clearing House, a payment processing network commonly used by banks and employers to deposit paychecks into employees’ bank accounts.

ACH is operated by the Federal Reserve Banks and the Electronic Payment Network.

Banks reiterated that customer accounts “remain secure” and the Federal Reserve said all services resumed operation at 16:44 UTC.

However, customers continue to complain about the situation. Georgiaree Godrey, an X (ex-Twitter) user, says she still hasn’t received her payment and can’t pay her rent. In response, the Bank of America Help account replied: “Hello. Some deposits made since September 11 may be temporarily delayed due to an issue affecting various financial institutions. Your accounts remain secure and your balance will be updated as soon as your deposit is received.”

Hello. Starting 11/3, some deposits may be temporarily delayed due to an issue affecting multiple financial institutions. Your accounts remain secure and your balance is updated as soon as the deposit is received. ^adrian

– Bank of America Help (@BofA_Help) 3 November 2023

Another X user, Des Imoto, pointed out that funds cannot be safe if they are missing, and that Bitcoin (Bitcoin) serves as a solution to the problem.

“This is the opposite of security as funds disappear. #Bitcoin solves the problem.”

X user LashishLizard also necessary He will inform Wells Fargo whether he will pay the default costs imposed on him.

“So you’re going to pay everyone’s late fees, court fees, and everything else related to this bullshit? Because loan companies, bills, landlords don’t want to hear that you don’t have any money.”, they commented. Below is the relevant response from the Bank of America Assistance account: “Hello, thank you for contacting us. We would like to see how we can help you. Please send us your full name/ZIP/phone number and we will be happy to contact you.”

Hello, thank you for reaching us. We’d love to see how we can help. Please send us your full name/ZIP number/phone number; We would be happy to contact you. ^adrian

– Bank of America Help (@BofA_Help) 3 November 2023

A. questionnaire CNBC found in September that 61 percent of Americans live hand-to-mouth; this rate was higher than 58 percent in March.

Related: JPMorgan Predicts a Modest Downturn for Crypto Markets

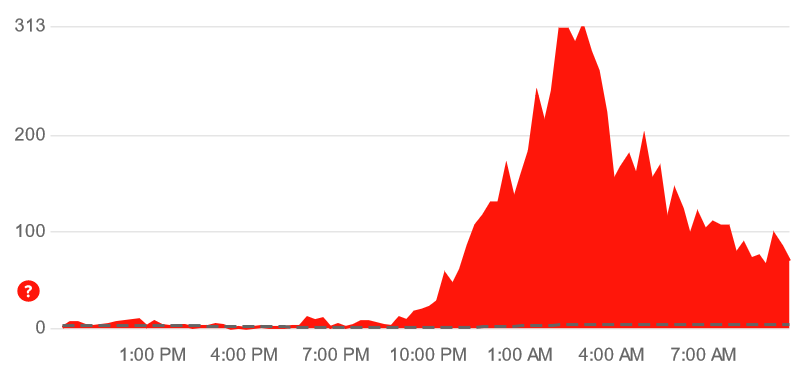

Reports of service outages from US banks began to increase around 11:00 a.m. UTC on November 3.

Second down detectorIt rose to 313 in a 15-minute span at 16:00 UTC, Bank of America reports. Chase and Wells Fargo reached similar highs of 279 and 137 around the same time.

Last July the Federal Reserve launched FedNowA service that allows banks and money transfer providers to make instant payments without having to rely on ACH.

Translation by Walter Rizzo