Entry into Bitcoin investment products reaches $1.5 billion

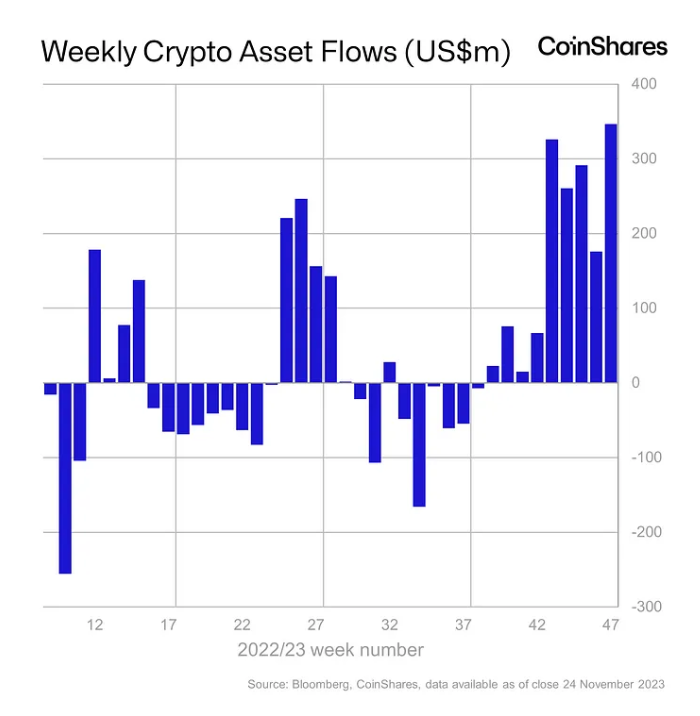

ETPs (exchange-traded products) in Bitcoin during the week of November 24, according to CoinShares (Bitcoin) saw inflows of $312 million, bringing the year-to-date total to nearly $1.5 billion. Weekly inflows into the overall cryptocurrency market totaled $346 million, continuing a nine-week positive net flow trend.

Sharing a tweet about X — CoinShares (@CoinSharesCo) 27 November 2023

This week saw a new inflow record of $346 million, the highest total in the last 9 weeks.

– #Bitcoin –

$BTC: $312 million inflow ($1.5 billion inflow since the beginning of the year)

Short Bitcoin: $0.9 million breakout

ETP volumes as a percentage of total spot Bitcoin volumes… pic.twitter.com/gMUPzTy0q4

A new inflow record was set this week with US$346 million; This is the highest total observed in inflows in the last 9 weeks.

– #Bitcoin –

$BTC: $312 million inflow (year-to-date inflow $1.5 billion)

Short Bitcoin: $0.9 million breakoutETP volumes as a percentage of total spot Bitcoin volumes… pic.twitter.com/gMUPzTy0q4

— CoinShares (@CoinSharesCo) 27 November 2023

According to the report, crypto ETPs had been experiencing outflows for several weeks before September 25, but starting September 26, the industry began experiencing consistent weekly inflows. The number of visitors increased over time. The highest inflows in nine weeks were recorded in the week ending November 24.

CoinShares said Canadian and German ETPs accounted for the majority of weekly inflows, at 87%. A modest inflow of $30 million was recorded into the United States.

Crypto funds as a whole now manage $45.4 billion, an 18-month high.

In a previous report, CoinShares noted that recent inflows May be influenced by increased optimism For approval of a spot Bitcoin ETF in the United States. On November 22, BlackRock met with the U.S. Securities and Exchange Commission to make progress toward this goal. Grayscale also met with the SEC for similar reasons.