BTC holders outperformed crypto funds by 69% in the first half

The classic buy-and-hold – or hold – approach to Bitcoin (bitcoin), outstripped most crypto funds by 68.8% in the first half of 2023.

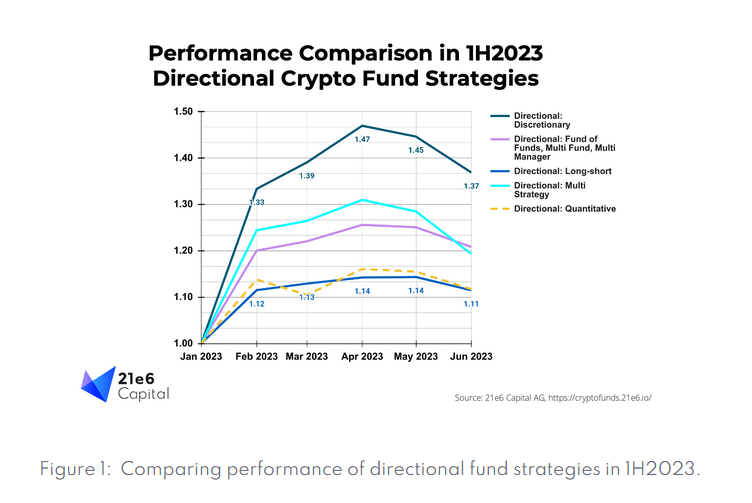

Crypto funds averaged 15.2% returns in the first half of 2023, according to data from Swiss investment advisory firm 21e6 Capital AG. BTC posting gains of about 84%.

Crypto funds averaged 15.2% returns in the first half of 2023

Crypto funds averaged 15.2% returns in the first half of 2023. pic.twitter.com/vb8pwYfiX9

— Alex Krüger (@krugermacro) August 5, 2023

Inside relationshipMaximilian Bruckner, head of marketing at 21e6 Capital AG, “It can often outperform Bitcoin significantly during previous bullish waves”.

Bruckner attributed much of the disappointing performance of crypto funds in 2023 to tough market conditions and the significant amount of liquidity they had in their hands in late 2022.

followingFTX burst and other crypto projects in 2022, according to the report many funds chose not to take risks and develop their liquidity reservesthus losing the possibility of a significant BTC price increase recorded in the first half of 2023.

“Funds with large cash positions will outperform Bitcoin in a bull market unless the funds’ holdings significantly outperform Bitcoin.”

“Due to the general sentiment in late 2022, many funds had larger-than-normal cash positions. In addition, most major altcoins underperformed Bitcoin, which was a tough backdrop for funds.”adds report.

At the time of this writing, BTC Listed for around $28,900continues Struggling to pass $30,000the threshold was reached for a short time and only a few times in 2023.

However, current prices for the asset have seen a 75% increase since Jan 1, according to data from CoinGecko.

“All cryptocurrency fund strategies have performed well this year. But they have underperformed against Bitcoin, especially those that are heavily dependent on altcoins, futures or momentum signals.”

“Going forward, we will be tracking which exchanges emerge as leading futures providers. Also, the level of funding rates in the cryptocurrency futures markets and the ability of quantitative funds to catch trends will be areas of focus when observing the markets.”adds report.

Ultimately, the document suggests a slight improvement in investor sentiment in the first half of 2023, suggesting that: some funds may soon start pouring more cash into the cryptocurrency space.

However, the report notes that the available data on inputs and outputs show that “a full recovery in sensitivity” has yet to occur.

Translation of Walter Rizzo