What will happen when all BTC is mined?

Satoshi Nakamoto released the first block on January 3, 2009top 50 Bitcoin mining (bitcoin) history and the beginning of what will become a billion-dollar industry centered on cryptocurrency mining. However, it will be possible to mine a maximum of 21 million coins.: It is still unclear what will be the fate of the miners after the last units are mined.

Bitcoins are generated through mining, a process that uses hardware devices to solve complex mathematical problems and verify transactions on the computer. blockchain. As a reward for his effort, the miner who manages to solve this problem is assigned a fixed amount of BTC for each confirmed block of transactions.

According to this Nakamoto whitepaper, only 21 million BTC could exist; When this limit is reached, miners they will no longer receive rewards pre-installed According to the Blockchain Council, To date, miners have received more than 19 million BTC in total. as a reward for completing blocks.

Nick Hansen, founder and CEO of bitcoin mining company Luxor Mining, told Cointelegraph that although there is no block reward, Miners will continue to play a vital role in verifying and transmitting transactions on the blockchain.. However, it will change the way you are rewarded.

Today, successfully verifying a new block on the blockchain rewards miners with 6.25 BTC (about $180,000 at the time of this writing). In addition to this reward, miners also receive commissions from transactions they confirm.

According to calculations developed and shared on May 1 by the on-chain analytics company glass knotSince 2010, the commissions and rewards accumulated by miners have reached a value of 50 billion dollars.

Since that time #BitcoinsAt the start of , Miners generated a total revenue of $50.2 billion from block subsidy and fees, with an all-time estimated input cost of $36.6 billion.

This puts the all-time total profit margin for Miners at $13.6 billion (+37%). pic.twitter.com/TYvBSZbsRo

— glassnode (@glassnode) 2 May 2023

Hansen believes that once the last BTC is mined, transaction fees will be the primary incentiveLet the miners continue their work.

“Therefore, as transaction fees become an increasingly important part of the Bitcoin mining economy, it becomes even more important to understand the dynamics of transaction fees and project them into the future. That is why it is important that fees increase over time, which, for example, helped make the Bitcoin Ordinals recently happened.”

In any case, we will likely see this change years from now: In fact, none of today’s miners will be alive when the last BTC is mined!

it will be a long road

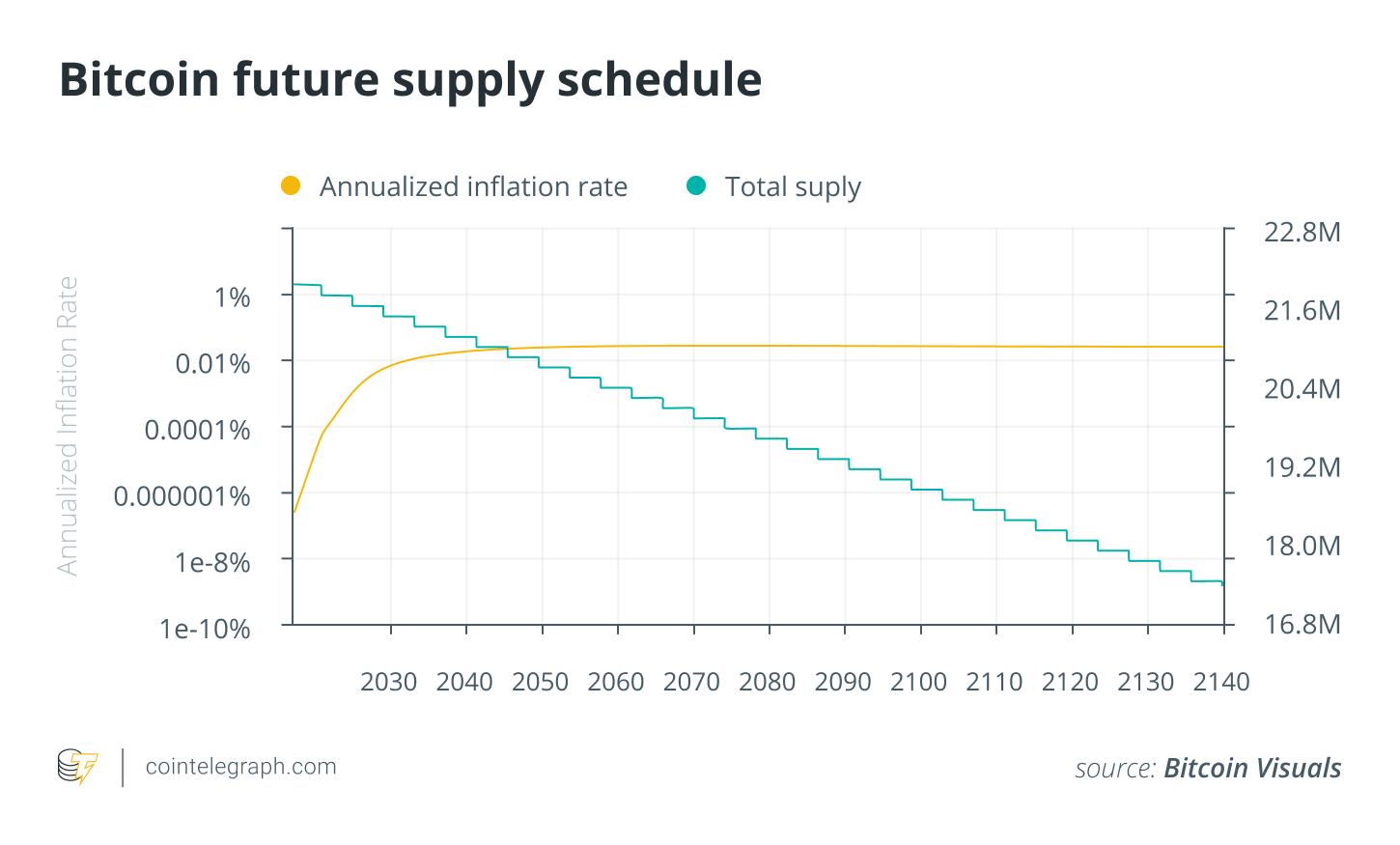

According to Hansen, the average time to find a block and halving processoccurs roughly every four years – or rather, every 210,000 transaction blocks The last BTC will be mined in 2140!

Bitcoin halving consists of a planned reduction of the reward received by miners. Next event scheduled for April 2024. This process will halve each block’s reward to 3,125 BTC. Theoretically, since Bitcoin is in limited supply, the value of any unit should increase as demand increases.

What will be the price of BTC in 2140? Given that price will depend on a wide variety of factors, it is impossible to answer this question: market demand, regulatory environment, technological innovations and macroeconomic variables. Hansen says the following about it:

“Having all Bitcoins in circulation can create shortages, but whether this will lead to a price increase will depend on market dynamics. It is important to keep in mind that all of this is already envisioned in Bitcoin: lowering the block reward and switching to transaction fees is an internal process of the protocol and a secure and efficient way of the network. It represents an ingenious solution to make it work the way it is.”

Also read: $160,000 in the next halving? Model counting down to Bitcoin’s next all-time high

As Bitcoin usage and adoption increases, Hashrate Index researcher Jaran Mellerud adds: commissions will increase. main source of income for miners.

In other words, when the last BTC is issued, the block reward will be so small that removing it completely will have almost no effect:

“In a future scenario where Bitcoin is widely used, due to the high demand for space in blocks due to its limitations, transaction fees will surely skyrocket. Who would believe that there won’t be many transactions in the future to justify the existence of Bitcoin mining, not really believing in Bitcoin.”

What about fiat currencies?

Mellerud, once the last BTC is mined, its value will no longer be expressed in US dollars or other fiat currencies.. Also, let’s assume that by then there will be a fiat system. already crashed for a while: Bitcoin could be its successor, which has become the standard unit of account globally. Mellerud explains:

“In such a context, the only correct way to assess the purchasing power of bitcoin would be to look at how much energy a BTC or a satoshi can buy regarding energy and the barrels of oil that can be bought.”

The collapse of fiat systems has long been predicted, given the many problems plaguing the traditional financial system. in March 2023 Silicon Valley Bank due to the liquidity crisis, Signature Bank And Silvergate Bank.

Even before the banking crisis of March 2023, questionnaire – Run by business intelligence firm Morning Consult and commissioned by the cryptocurrency exchange in February. coinbase – found that most users have already lost faith in the global financial system.

Bitcoin may not be the same in 120 years

Pat White, co-founder and CEO of digital asset platform Bitwave, believes that miners will continue to be an important part of the ecosystem; but not all will survive given the rising costs they will face.

according to a research Posted by Glassnode on March 24, Miners have faced long periods of not making a profit since 2010.: only 47% of total days were profitable.

white says:

“I believe that many miners will go bankrupt or we will see manipulation techniques used in an attempt to raise fees. But I also believe that this will happen long before the last bitcoin is mined, because the latest halvings will subside.” The reward is a few satoshis.

In both cases, the CEO adds, “A lot can happen in 120 years“: Bitcoin could transform dramatically in the next century. According to White, probably as early as 2140. quantum computers Will be able to break the current cryptography that supports Bitcoin:

“The problem with quantum computers doesn’t have to scare people. Between now and 2140 there will be a major cryptographic overhaul in Bitcoin.

At this point, the Bitcoin developer community will be able to see if we are on the right track for a functioning network based on transaction fees or if new mining processes need to be implemented to ensure network security.”

White also hypothesizes that none of us would be alive to enforce this rule in 2140, even though Satoshi Nakamoto’s white paper puts the maximum limit of 21 million circulating BTC as a column.

Believes that the essence of cryptocurrencies is encryption and consent: If the community believes that incentivizing transaction fees is not enough to keep the network secure, the miners of the future will theoretically be able to increase the maximum supply of bitcoin to over 21 million units.

The impact of this change on prices is unknown. In any case, White thinks that the value of BTC will be greatly affected by global inflation. Also, the biggest price move will occur in the next 120 years. selects one or more nations BTC as reserve currency.

“Events we can’t even imagine, such as wars and energy crises, can affect Bitcoin,says White.What if we had become a multi-planetary species by then and had to extend the production time of the blocks to support the speed of communication across the solar system?“

“It’s always important to me to focus on the most difficult problems to solve and do your best to solve them. This could mean solving problems with payments, digital property or unbanked banking – that’s what you need to focus on right now.” ”

Translation of Giorgio Libutti