Trader predicts a 10% decline to come

Bitcoin in the coming weeks and beyond (Bitcoin) could benefit from a familiar starting point if macro conditions confirm themselves.

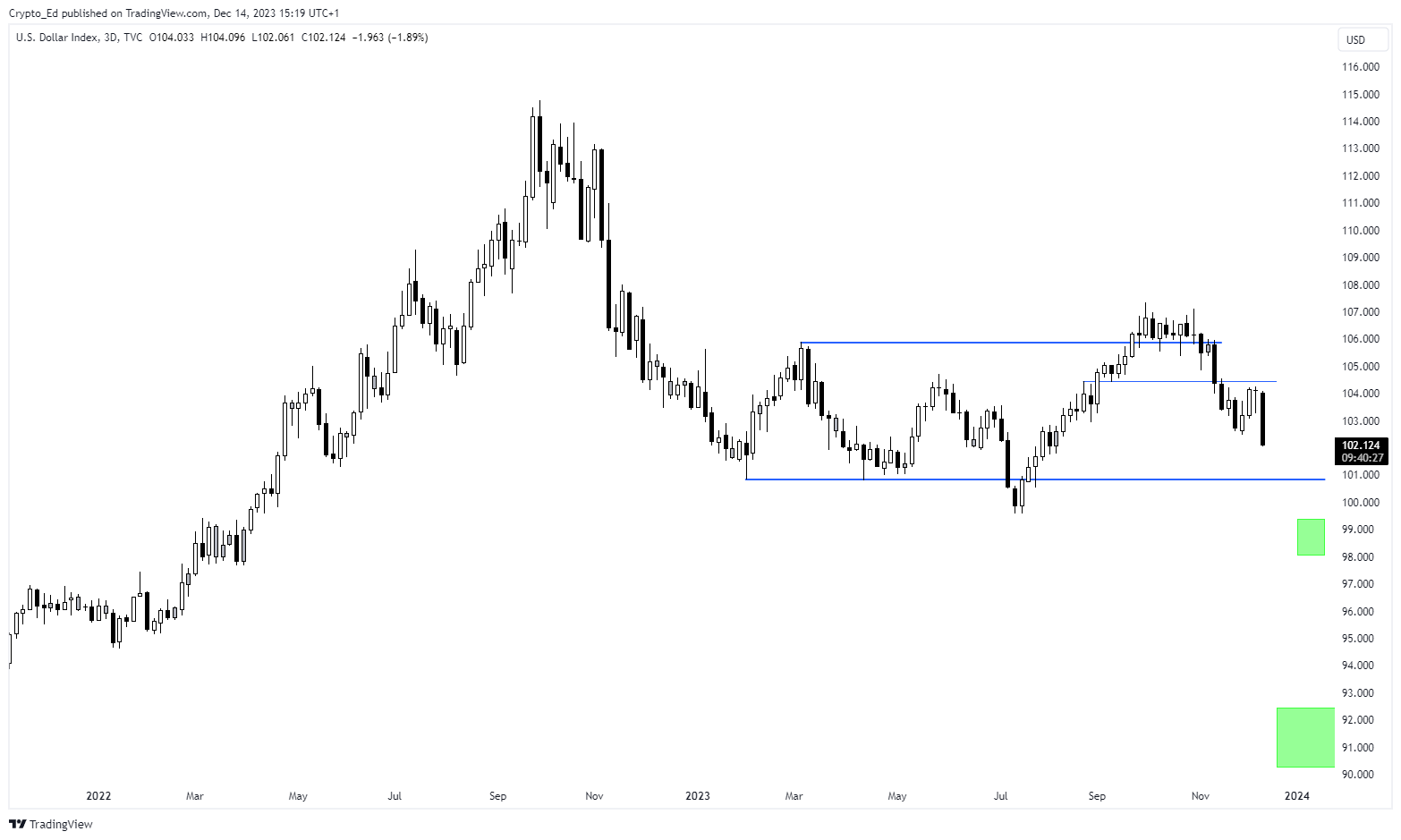

Inside Post published on X (formerly Twitter) On December 14, popular trader Crypto Ed, founder of the CryptoTA trading group, predicted multi-month lows based on the strength of the US dollar.

Bitcoin investors aim for DXY to fall below 100

In the past, Bitcoin and dollar strength showed an inverse correlation. Although like this correlation has decreased recentlyChanges in US macro policy are believed to favor Bitcoin but put pressure on the dollar going forward.

As Cointelegraph reported, this week’s macro data, combined with encouraging signals from the Federal Reserve, are showing analysts a way out. More upside in crypto markets In 2024.

This is all thanks to a decline in inflation, which could allow the Fed to “change course” on interest rate increases and increase liquidity to the benefit of risky assets.

One asset that will not benefit from the consequences of this change will definitely be the dollar, which has fallen rapidly this week due to macro data showing the impact of monetary tightening on inflation.

Since the beginning of the week, the US dollar index (DXY) has fallen more than 2% and is now below $102, its lowest level since mid-August.

Commenting on Crypto Ed, along with the optimists, predicts that the downward pressure on DXY will continue.

“Long-term outlook for DXY supports new all-time highs for BTC/USD”” says the merchant.

“DXY towards $92.”

The chart above – over a three-day time frame – highlights important levels to watch out for in DXY.

Fed increases its balance sheet

But on liquidity, economist Lyn Alden argued that conditions were not yet optimal to support a broad recovery in risk assets.

Related: Bitcoin: BTC Recovery Target as Repercussions of Liquidity Coming in Late 2020

“Global liquidity indicators have started to stall somewhat after their recent rise and reverse repos failing to drain in the first half of December, but the Fed’s dovish stance and today’s DXY decline have potentially restarted some liquidity.”, Alden explains X On December 14th.

However, Alden later noted: “Pretty notable repricing.” Markets are evaluating the possibility of the Fed’s interest rate cut in 2024 and commenting as follows: “While DXY turned downward today, crude oil and other commodities recorded a parallel recovery. There has been a notable re-pricing of forward interest expectations in the market in the last 24 hours.”

DXY is in decline again today, and there is a parallel recovery in crude oil and other commodities.

In the past 24 hours, it has been observed that the market has made a remarkable re-pricing of forward interest rate expectations. pic.twitter.com/Wz9alU3hGe

— Lyn Alden (@LynAldenContact) December 14, 2023

THE Data from the Fed itself It shows that its balance sheet increased by nearly $2 billion in December for the first time since August.

At the time of writing, BTC/USD is trading at $42,000 and continues the corrective trend. However, according to Cointelegraph Markets Pro And Trading ViewThe asset increased by 11.5% monthly.

This article does not contain investment advice or recommendations. Every investment and trading transaction involves risk, and readers should conduct their own research before making a decision.

Translation by Walter Rizzo