Three reasons why Bitcoin defends the $30,000 support

Bitcoin price gave up some of its recent gains this week. However, few data show that $30,000 support will likely continue.

bitcoins (bitcoin) remained in a narrow range of 4.3% for about two weeks. Despite the narrow gap between $29,895 and $31,165, investor sentiment was negatively impacted by the failure of an attempt to break the $31,400 wall.

Traders’ tendency to overreact to short-term price movements – forget about it The price of the asset increased by 82% year-to-date – may be one of the reasons for the recent fix. The same logic generally applies to other cryptocurrencies.

Investors are now wondering how recent demand for Bitcoin ETFs has affected the price increase.

There is also negative news from Binance: Chief Strategy Officer Patrick Hillmann and other key members of the compliance team launched the exchange on July 6Following CEO Changpeng Zhao’s response to the US Department of Justice investigation.

Also, the US interest rate yield curve peaked on July 3. Deepest comeback since 1981: While the interest rate of the 2-year bond is 4.94%, the interest rate of the 10-year bond is 3.86%. This is the opposite of what is expected from long-term bonds. This phenomenon is currently being watched closely by investors. often preceded by past recessions.

All these events likely affected both BTC price and investor sentiment.

Traders show strength in margin, options and futures markets

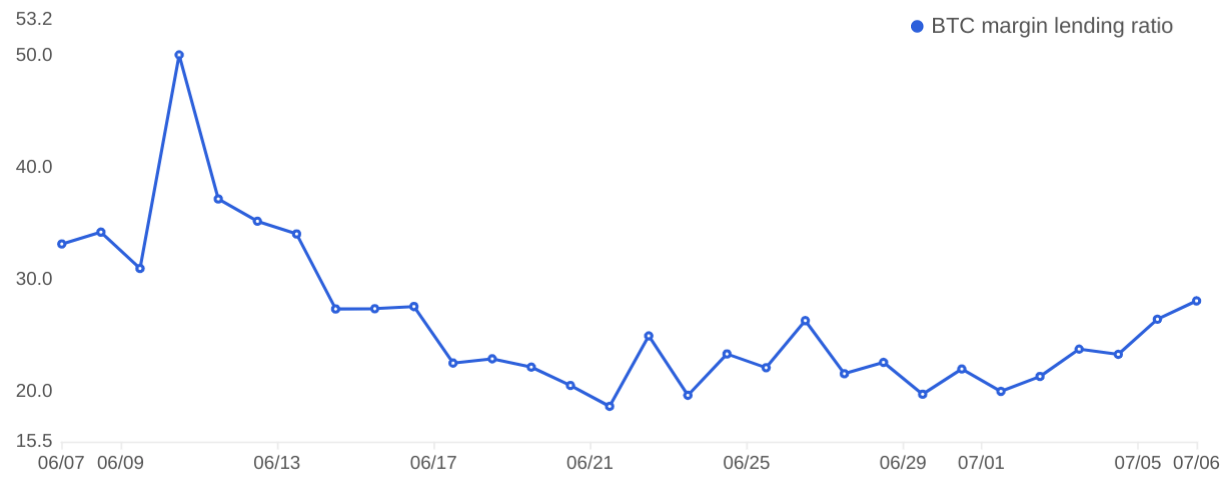

OKX’s margin lending indicator based on the stablecoin/BTC ratio has increased significantly: From 20x in favor of longs on July 1 to 29x on July 7. This metric indicates increased confidence among traders using margin loans. Also, it is still in a bullish-neutral range. below the historical 30x threshold associated with over-optimism.

In other words, the chart shows no signs of stress for a sudden BTC price correction in the margin markets and there is room for longer leverage.

Traders do not buy protective sales and increase short positions

Traders can also gauge market sentiment by measuring whether there is increased activity in their buy (buy) or sell (sell) options. A buy ratio of 0.70 indicates that the open interest of put options is lower than buys; if so, the emotion is on the rise. Conversely, an indicator of 1.40 supports put options and can be considered bearish.

Put-to-call rate has been below 1.0 for the past three dayssuggests more preference for neutral-bullish call options. The key takeaway is that while Bitcoin price briefly dropped below $29,750 on July 7, We did not see a significant increase in protective put options..

The long-to-short ratio of top traders only excludes externalities that may have affected the options markets. From time to time there may be methodological differences between different exchanges, so changes should be tracked rather than absolute numbers.

The long-short ratio of OKX top traders increased from 0.52 on July 3 to 1.68 on July 7This indicates strong demand for leveraged long positions, although BTC failed to break past $31,000. However, on Binance, the indicator dropped from 1.52 on July 3 to 1.39 on July 7.The previous 30-day average remains above 1.33, indicating neutral sentiment.

Bears will have a hard time as the market waits for an ETF to be approved

Natalie Brunell — TV reporter, podcast host, and Bitcoin educator — said: cryptocurrency is now taken seriously by institutions: Multiple applications for a spot ETF show this, including from some of the world’s largest fund managers.

In a recent Fox Business post, BlackRock CEO Larry Fink even said so. Bitcoin’s role is mainly “digitize gold“prompts US regulators to consider how a spot ETF could democratize finance. According to Fink, investors may turn to Bitcoin as an inflation hedge or devaluation of some currencies.

In other words, after the rally fueled by rumors of an upcoming US spot ETF, Bitcoin doesn’t seem to be heading for a correction. in reverse, trader sentiment looks pretty bullish: Options and futures markets show that the time for bears is approaching.