Tether Stablecoin Loans Increase in 2023 Despite Scaling Announcement

On Tether in 2023The largest stablecoin issuer in the crypto market, Stablecoin loans increasedSecured loans or secured loans, although the company announced the cancellation of these loans in December 2022.

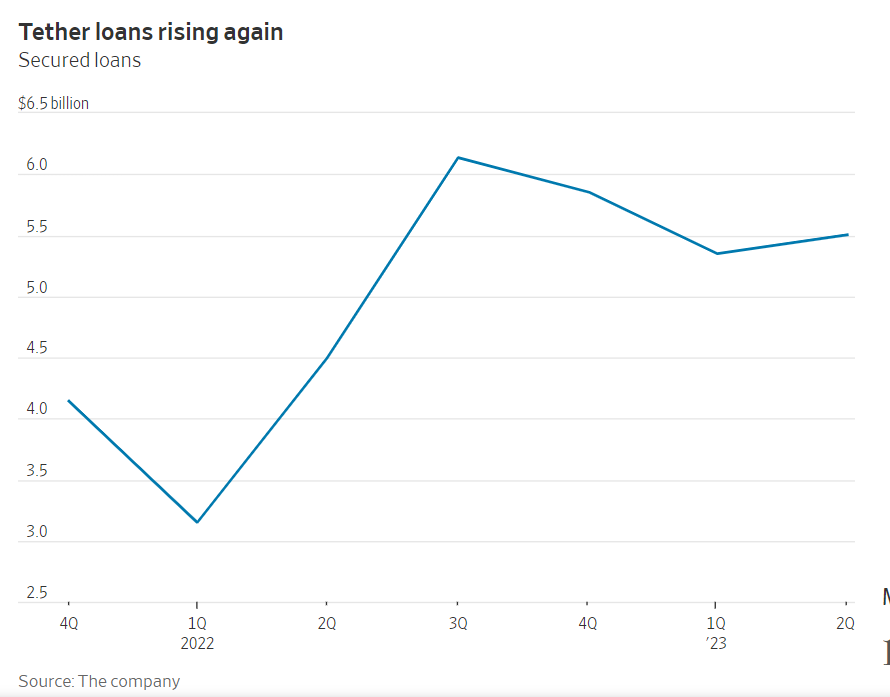

In the company’s last quarterly report, Tether stated that its assets consisted of $ 5.5 billion in loans as of June 30It was $5.3 billion in the previous quarter. Tether spokesperson he declared The reason for the recent increase in stablecoin loans, he told the Wall Street Journal (WSJ) Some short-term demands from customers with whom the company has a contract “developed long-lasting relationships.” The spokesperson also said the company expects to eliminate these loans by 2024.

Stablecoin loans have become a very popular product for TetherBecause they allowed customers to borrow USDT from Tether in exchange for some collateral. However, these secured loans have always been controversial due to lack of transparency regarding collateral and borrowers.

an article A report from the WSJ published in December 2022 expressed concerns about the products and He said the loans were not fully secured. The WSJ questioned Tether’s ability to meet payment demands in times of crisis.

Bond faced Discussions in 2022 before announcing plans to eliminate secured lending in 2023. At the time, the stablecoin issuer raised concerns about secured lending. “FUD” And He claimed that the products were over-collateralized.

The recent surge in secured loans comes amid a backdrop where the company is growing in terms of market dominance and profits. In September, Tether reports $3.3 billion in excess reservesIt was $250 million in 2022. Cointelegraph reached out to Tether for comment but did not hear back.