Reactions to Hong Kong Bitcoin spot ETF news

The crypto community is reportedly excited that the Hong Kong government is considering this issue. lunch The existence of a spot fund (ETF) traded on a crypto exchange despite continued regulatory resistance to such products being adopted in the United States.

According to the co-founder of BitMEX Arthur HayesHong Kong’s potential entry into spot crypto ETFs could represent a significant development in the economic conflict between the US and China.

Speaking on X (formerly Twitter) today, Hayes expressed his excitement about the competition between the two economies and underlined that this competition will have positive results for Bitcoin (Bitcoin).

“The competition is incredible. If BlackRock, the US proxy asset manager, is launching ETFs, China needs it too.”He concluded his words as follows: “The economic war between the USA and China is beneficial for BTC”.

The competition is amazing. If the US has proxy asset manager BlackRock to launch an ETF, China needs proxy asset manager to launch an ETF.

US-China economic war is great for us $BTC. pic.twitter.com/ok7xipN4M5

— Arthur Hayes (@CryptoHayes) 6 November 2023

Even the cryptocurrency group Currency Bureau He was quick to react to the potential launch of a spot crypto ETF in Hong Kong. According to the research, the US Securities and Exchange Commission (SEC) may be under pressure from other jurisdictions such as Hong Kong, which is planning to launch a spot Bitcoin ETF.

“This is a way of telling the SEC that if it continues to stifle capital markets innovation in the United States, other countries will fill the gap.”Coin Bureau reported.

Influencer Lark Davis also highlighted that the latest news regarding the financial product from Hong Kong shows that the Chinese government does not intend to miss the opportunities offered by cryptocurrencies.

“Hong Kong is about to launch a Bitcoin spot ETF! Chinese currency does not want to miss this opportunity”Announced davis.

Securities and Futures Commission CEO, Bloomberg reported on Nov. 5. Julia Leung, is considering allowing retail investors to access spot ETFs on cryptocurrencies such as Bitcoin, provided regulatory requirements are met. SFC did not immediately respond to Cointelegraph’s request for comment.

Hong Kong’s potential entry into Bitcoin spot ETFs comes as at least one dozens of investment companies Companies in the United States are planning to launch similar products in the country, despite long-standing blocks from the Securities and Exchange Commission (SEC).

While both Hong Kong and the US have permitted crypto ETFs linked to futures contracts, the jurisdictions have yet to approve a spot product. Unlike a futures ETF that tracks futures contracts to copy BTC prices, Bitcoin spot ETF holds BTC directlyIt provides investors with exposure to the asset.

Related: Excitement over Spot Bitcoin ETF has reignited interest in blockchain gaming

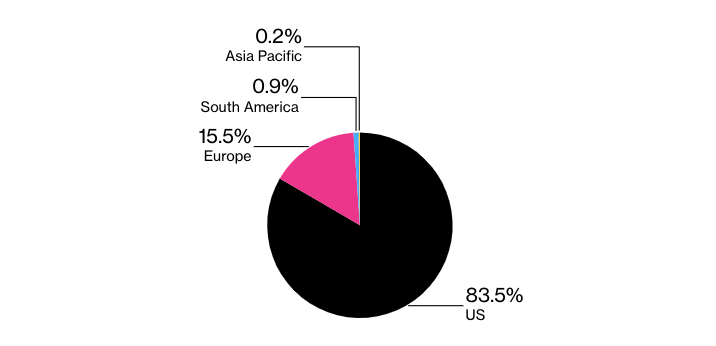

The United States became the first country to launch futures-linked crypto ETFs in 2021, while Hong Kong followed suit in late 2022. launch of futures products CSOP in cryptocurrencies. According to Bloomberg, Hong Kong has around $65 million in cryptocurrency ETF assets, along with the Samsung Bitcoin Futures Active ETF. Crypto ETF futures hit record Demand is low in Hong KongIt still has a minimal share compared to other global cryptocurrency funds.

Hong Kong and Shanghai Banking Corporation, Hong Kong’s largest bank, will allow its customers to buy and sell Bitcoin and Ethereum-based ETFs (ETH) from June 2023.

Translation by Walter Rizzo