Marathon and Riot are among the most valuable Bitcoin mining stocks

According to Jaran Mellerud, founder and analyst of MinerMetrics, the heavyweights of Bitcoin mining (Bitcoin) Marathon Digital and Riot Platforms are among the most valued mining companies compared to their competitors.

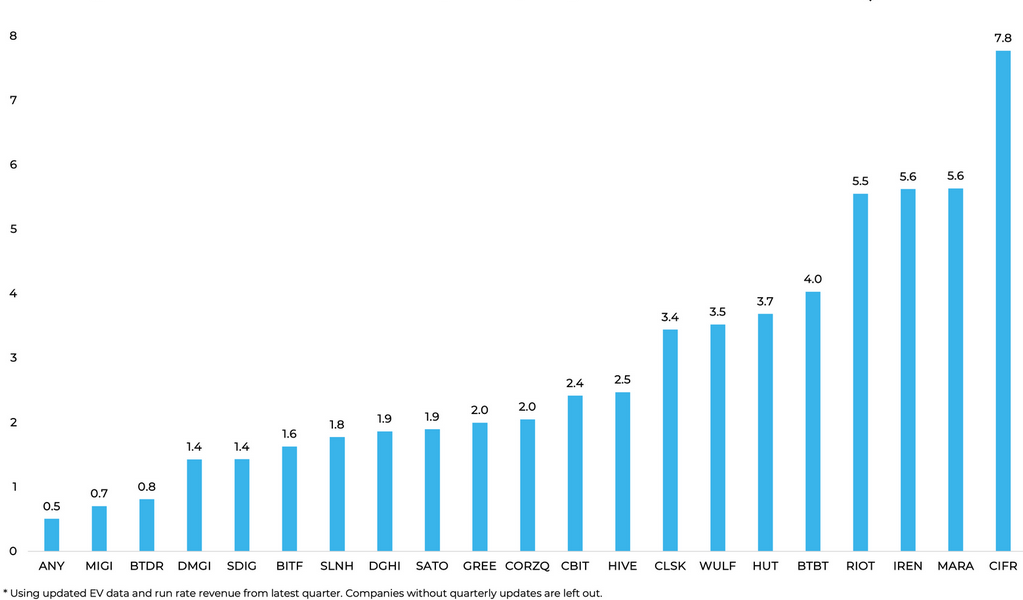

The key metric supporting Mellerud’s claim is the enterprise value-to-sales ratio (EV/S), which measures a company’s value relative to its revenue. The higher the ratio, the more valuable the company is.

According to a relationship According to the report published by Mellerud on November 3, the miners with the highest EV/S ratio were Cipher with 7.8, Marathon and Iris Energy with 5.6, and Riot with 5.5.

Mellerud attributed the giant’s high EV/S ratio to growing interest from institutional players such as BlackRock.

“These companies have historically been favored by institutional investors like BlackRock and Vanguard, giving them greater access to capital and higher valuations than the rest of the industry.”

Mellerud told Cointelegraph that he expects investors to start investing in other operators in the coming months: “this could smooth out valuation differences between stocks”.

He suggested that there are more attractively priced opportunities with lower EV/S ratios that could be considered.

“There are huge valuation differences in the Bitcoin mining industry that value-conscious investors can take advantage of.”

Riot’s high EV/hash rate ratio of 156 is another indicator of overvaluation, according to Mellerud.

Mellerud, formerly an analyst at Luxor Technology, noted that Riot boasts “exponential growth” as it builds its one gigawatt facility and expects delivery of 33,000 MicroBT units in early 2024.

“Additionally, Riot has several business lines that are not reflected in the auto-mining hash rate, which means we need to be careful when drawing valuation conclusions from a high EV-to-hash rate ratio.”added Mellerud.

The Bitcoin mining industry has made a strong recovery in 2023, led by Marathon (MARA) and Riot (RIOT), whose stock prices are up 170% and 228%, respectively, according to Google Finance.

Me too in the same period mining stocks According to data, it has outperformed Bitcoin, which has gained 113% value to date. Cointelegraph Markets Pro.

Relating to: Report: Bitcoin mining could help reduce global emissions by up to 8%

Not all mining analysts believe mining stocks will continue to rise.

Founder of Cubic Analytics, Caleb FranzenHe emphasized that Bitcoin has already reached its annual price peak, while major mining stocks are still more than 75% away from their annual highs.

Franzen wondered whether Bitcoin mining companies would have to do this soon. double their productivity In light of Bitcoin’s upcoming halving event.

“If block rewards are halved, the price of BTC will need to double after the halving for their business to be as sustainable as it was before the halving.”

Marathon has the largest Bitcoin holdings among mining companies: 13,726 BTC worth $486.1 million. Hut 8, Riot, and CleanSpark follow with holdings of 9,366 BTC, 7,309 BTC, and 2,240 BTC respectively.

Translation by Walter Rizzo