G20 issues joint policy recommendations for crypto assets at request of IMF and FSB

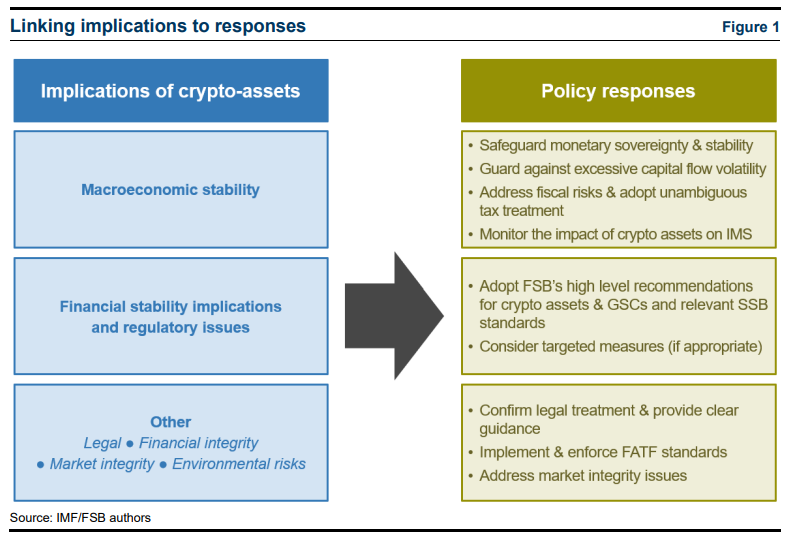

At the request of the G20 India Presidency, the International Monetary Fund (IMF) and the Financial Stability Board (FSB), published A joint document containing policy recommendations. The organizations drafted the document to unify standards and consolidate collective recommendations to provide guidance and help various jurisdictions address the risks associated with cryptoasset activities.

The document includes recommendations for regulating activities related to stablecoins and decentralized finance (DeFi). It also explains how the regulatory frameworks and policies developed by the IMF and FSB can interact and combine with each other. But, Does not define or establish new policies, recommendations or expectations for authorities.

According to the document, stablecoins, which were created to maintain a stable value, face the risk of experiencing sudden fluctuations and posing a major risk to financial stability. Regarding DeFi protocols, the report claims that the processes used to provide services may differ from traditional financial platforms. DeFi “It does not differ significantly from the traditional financial system in terms of the functions it performs.”.

Related: Binance CEO Predicts DeFi Will Overtake CeFi in the Next Bull Run

The article also notes that DeFi attempts to replicate some of the functions of the traditional financial system while also Strengthens and inherits risks and vulnerabilities of traditional systems. These include possible liquidity and maturity imbalances, operational vulnerabilities, interconnectedness and leverage. As stated in the document:

“Promises of decentralization often do not stand up to scrutiny. Currently, DeFi offers unclear, opaque, untested or easy-to-manipulate governance frameworks that can expose users to risks.”

The report also reiterated the IMF’s stance on the blanket ban on cryptocurrencies. On June 22, the IMF emphasized that: Banning cryptocurrencies may not be effective in the long run. Rather than banning cryptocurrencies, authorities should focus on what drives demand for cryptocurrencies, including consumers’ need for digital forms of payment, according to the IMF.

Translation by Walter Rizzo