Excitement over spot ETFs predicts Bitcoin fees will skyrocket

The possibility of a Bitcoin exchange-traded fund (ETF) (Bitcoin) The soon-to-be-approved cryptocurrency in the United States has increased demand for the cryptocurrency with the largest capitalization and led to an increase in transaction fees.

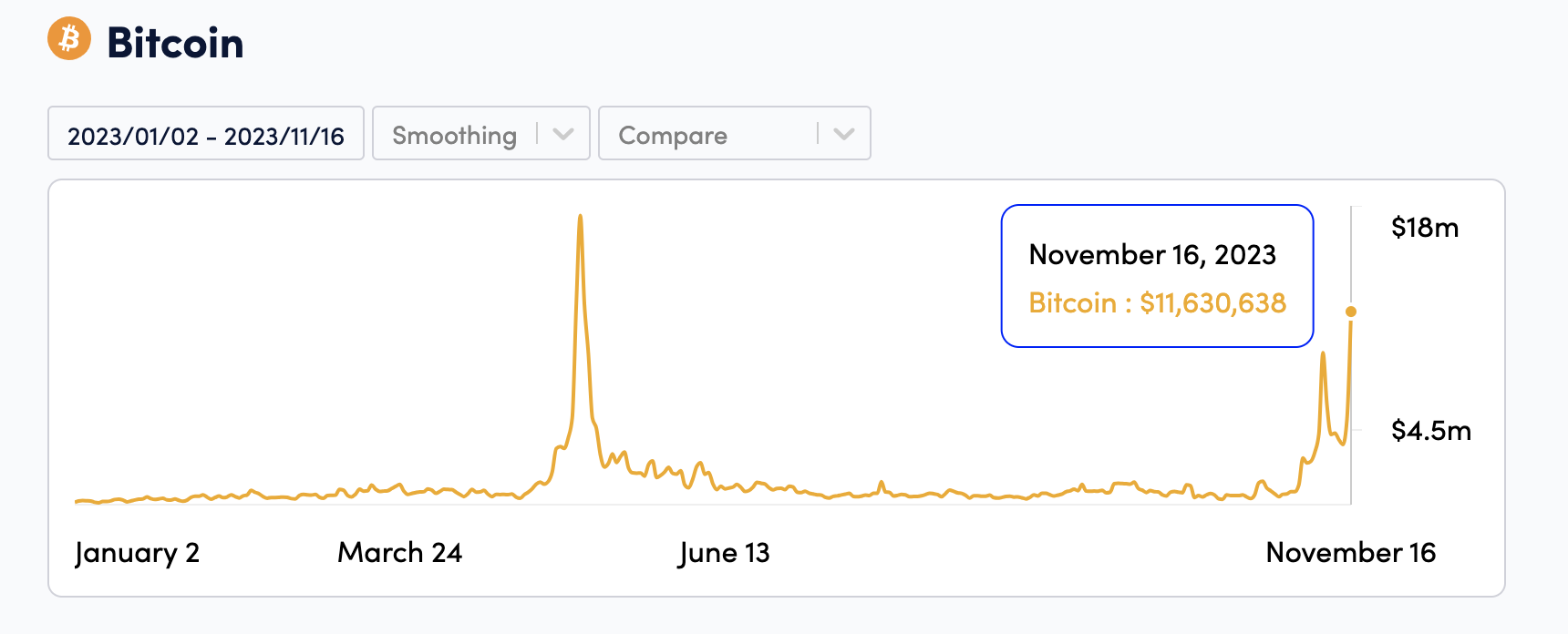

According to CryptoFees statistics, fees paid on the Bitcoin blockchain on November 16 reached $11.6 million. At the time of this writing, YCharts data reports the average wage is $18.69, up 113% from the previous day and 746% from a year ago.

According to market analysis CointelegraphBitcoin remains near 18-month highs and above a bear market trading range. The cryptocurrency is currently trading at $36,500, up 0.58% in the last 24 hours.

Bitcoin’s spot price has been rising since Wall Street investment manager BlackRock filed for a BTC spot ETF with the Securities and Exchange Commission in June. Following BlackRock’s request, several other major asset managers in the US, such as Fidelity, ARK Invest and WisdomTree, also made similar offers. Account ₿ Isaiah commented “#Bitcoin has officially surpassed ETH in daily fees for the first time in 3 years.”

#Bitcoin Officially reversed ETH in daily fees for the first time in 3 years. pic.twitter.com/2G3t6j64TP

— ₿ Isaiah⚡️ (@BitcoinIsaiah) 17 November 2023

Although the SEC appears to be contacting companies about adjustments to the offering, it has not yet made a decision and has postponed the deadline to January 2024. WisdomTree amended its Form S-1 with the regulator on November 16, and a similar amendment was subsequently made. Changes to ARK and 21Shares, Valkyrie, Bitwise and VanEck.

The modified versions could be a response to concerns raised by the SEC, according to Bloomberg senior ETF analyst Eric Balchunas. “This means ARK has taken the SEC’s comments and responded to them all, and now leaves the ball in the SEC’s court.”Balchunas reported. “I think it’s a good sign, solid progress.”.

Bitcoin spot ETF is an investment fund that reflects the price of Bitcoin. The “spot” aspect means that the fund directs the purchase of Bitcoin as the underlying asset. It allows investors to participate in the Bitcoin market through regular brokerage accounts. This is a way to gain exposure to BTC price fluctuations without having to buy it on a crypto exchange, for example.

As a result, the Bitcoin spot ETF is expected to attract capital from institutional investors, which could lead to the Bitcoin price reaching new highs in the coming months. According to Bloomberg analysts, there is a 90% chance that all proposals will be approved in the same time frame in January.

Translation by Walter Rizzo