Coinbase shares up 50% on SEC action

Shares of the company have risen recently as cryptocurrency exchange Coinbase faces a securities infringement lawsuit in the US.

Coinbase shares have risen more than 50% since the US Securities and Exchange Commission (SEC) filed a lawsuit against the company for allegedly offering unregistered securities.

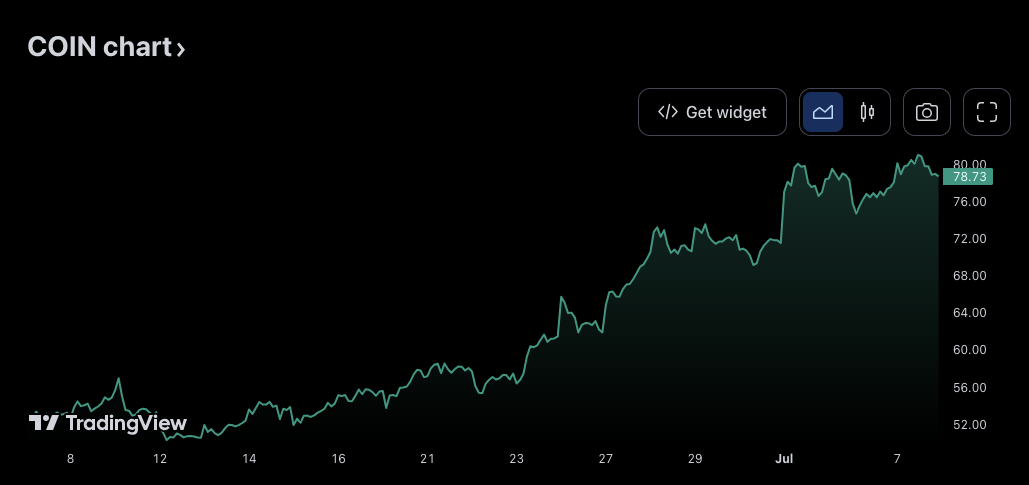

Coinbase shares rose 51%, according to TradingView data. From about $52 on June 6 to $78.7 on July 7. The stock is also up about 133% in the last six months, with year-over-year growth of around 50%.

Despite the significant growth backdrop, some major Coinbase shareholders continued to sell some of their shares.

On July 6, some of Coinbase’s top executives, including its CEO, Brian ArmstrongIt sold a total of 88,058 shares worth approximately $6.9 million.

According to official documents The transactions filed with the SEC included the sale of 4,580 shares by Coinbase board member Gokul Rajaram, the sale of 1,818 shares by General Counsel Paul Grewal, and the sale of 7,335 shares by Chief Accountant Jennifer Jones.

Before Jones Sold On June 29, 74,375 Coinbase shares raised $5.2 million.

While Coinbase executives are selling steadily, some major investors continued to hold their positions.

Since the investment firm bought another 400,000 shares of Coinbase in early June ARK Investment related to Cathie Wood According to the company’s portfolio updates, he did not sell any of his shares. This is in line with Wood’s view that as the price of Bitcoin rises, so will the share price of Coinbase (bitcoin).

On June 19, ARK Invest CEO ha They reaffirmed their belief that Bitcoin will one day catch up. $1 million for a single coin.

Translation of Walter Rizzo