Coinbase increases market share after Binance’s legal troubles

Last week, cryptocurrency exchange Binance reached a multibillion-dollar settlement with US regulators. On-chain data shows Coinbase’s market share increased following the event.

On November 21, Binance and the US Department of Justice reached a $4.3 billion settlement to resolve alleged anti-money laundering violations. It seems that this news scared many users who switched from Binance to other trading platforms.

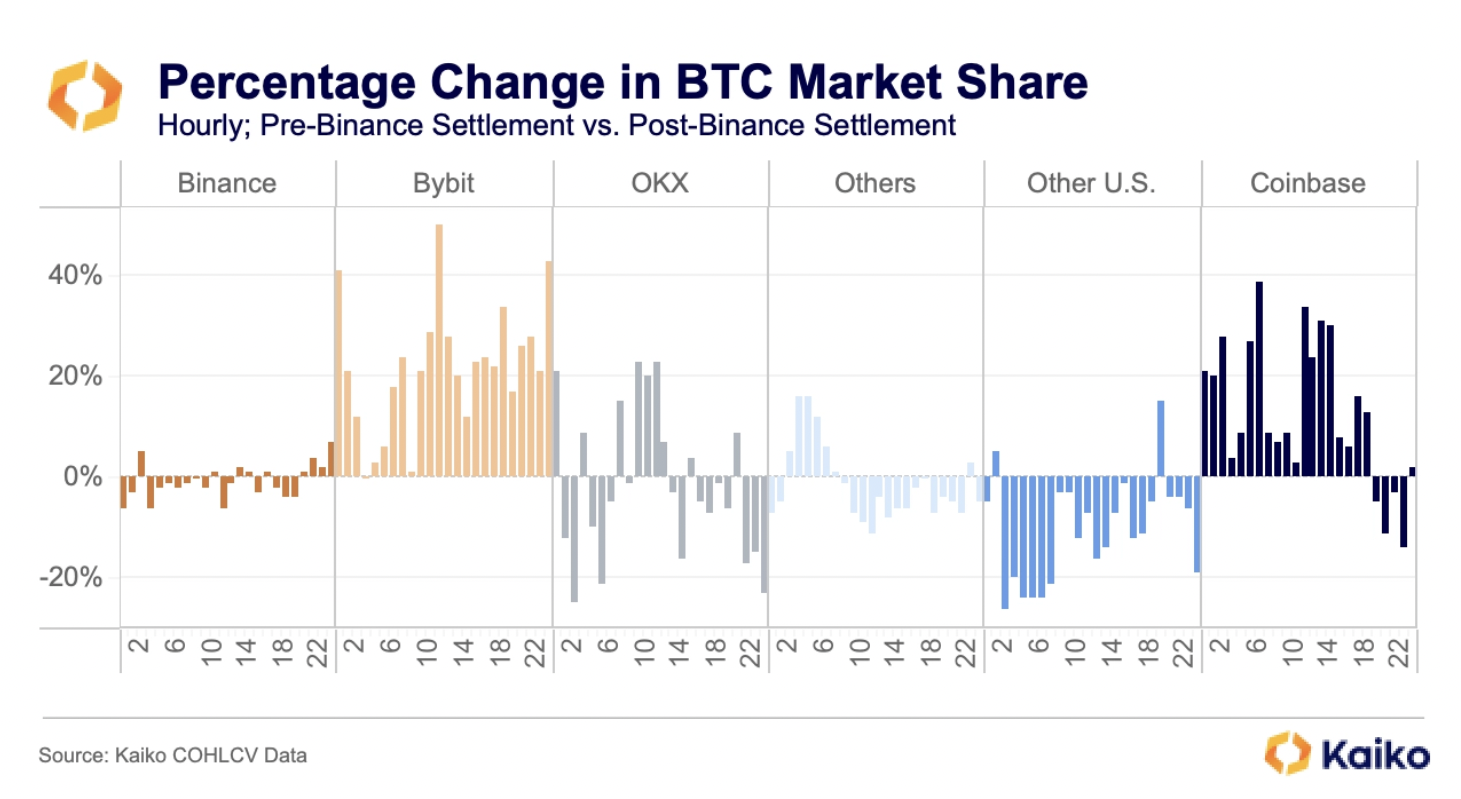

According to the research firm Kaiko ResearchCoinbase reportedly noted an increase in trading volumes during European and Asian business hours:

“Coinbase’s share increased the most outside of US trading hours (14-22 UTC), instead increasing during mid-day in Europe and early in the day in East Asia.”

Bybit also seems to have benefited from Binance’s recent misfortunes: “Bybit is one of the biggest winners in the story; It is gaining market share every hour and growing by over 20% in just 16 hours.” claims the Kaiko Research report.

But despite the legal challenges, we have not seen a large influx of assets from Binance. “While Coinbase’s volume share is increasing, Binance remains the liquidity leader for both BTC and altcoins.“says the researchers.

Meanwhile, some industry leaders are criticizing Binance’s plea agreement with the DoJ. a positive event both for the company and the entire cryptocurrency industry. Galaxy Digital’s Mike Novogratz commented: “I think this was a big risk-taking move. People were afraid to do business with Binance, now there is much less to worry about.“