Celsius could refund everyone if Bitcoin and Ether prices doubled

Failed crypto lender Celsius is on the verge of Chapter 11 bankruptcy, with multiple operators claiming billions of dollars. A new forecast from Bank of the Future suggests that the struggling company could reimburse anyone if it quotes Bitcoin (bitcoin) and Ether (ETH) – two assets held by the firm – doubled current market prices.

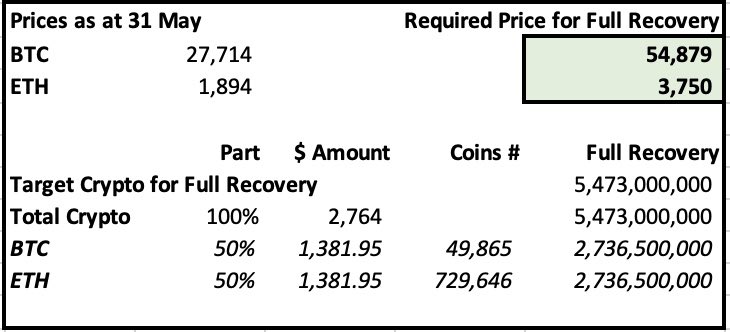

Simon Dixon, founder of cryptocurrency-focused investment firm Bank of the Future, tweeted his prediction about the price BTC and ETH would have to reach for Celsius to pay back holding all remaining assets.

As part of the final agreement with the Fahrenheit consortium, won the tender If BTC reaches $54,879 and ETH $3,750 for the purchase of Celsius assets in May, Celsius can repay all its debts thanks to the appreciation of the price of both assets. In June, Celsius filed an appeal with the court. convert all your altcoins to Bitcoin and Ether to maximize asset value.

Dixon, these estimates “Misunderstandings by BF’s internal investment banking team [Bank of the Future] without access to privileged sources of information”. Fahrenheit’s new restructuring plan includes mining, institutional lending, approximately $1.4 billion in investments and $450 million in liquid cryptocurrencies.

The firm also shared how Fahrenheit’s bailouts compare to those of the Blockchain Recovery Investment Consortium (BRIC), a holding company owned by Winklevosses’ Gemini Trust. Total collections under regular liquidation were $3.519 billion, exceeding total usable assets of $3.417 billion. This inconsistency is due to variable costs.

Returns for individual borrowers are approximately $339 million. According to Bank of the Future’s estimates, the recovery for both options is around 65%, and assuming 10% of the settlements remain unclaimed, this rate could rise to around 75%. Of the recovery under the Fahrenheit plan, 41.4% is in equities, while the remaining 58.6% is in liquid cryptocurrencies. Only 12.4% of the recovery under the regular liquidation of BRIC is in equities, while the remaining 87.6% is in liquid cryptocurrencies..

Dixon said that creditors must struggle to exit bankruptcy proceedings before the end of 2023 or before the price of BTC and ETH reaches their estimated levels. He added to avoid “One more carpet pull, if it comes, you’ll have to fight hard against it”.

It’s crucial to get out of Chapter 11 before #Bitcoin and $ETH approach these numbers, to avoid another tough fight that we’ll have to fight hard for if that happens.

Estimated price of #BTC and $ETH at which claims can be paid in full (on a 50/50 basis):

It’s very important that we get out of Chapter 11 as soon as possible. #Bitcoins & $ETH Approach these numbers to avoid another carpet pull, which we’ll have to fight hard if it comes up.

estimation of the price #BTC And $ETH Payable in full (on a 50/50 basis): $BTC… pic.twitter.com/PITQV3pIGM

— Simon Dixon (@SimonDixonTwitt) 19 July 2023

Translation of Walter Rizzo