Cathie Wood’s ARK sold 700,000 GBTC shares in one month

Last month, Cathie Wood’s investment firm, ARK Invest, sold 700,000 shares of Grayscale Bitcoin Trust (GBTC) despite Bitcoin (Bitcoin) rose to 17-month highs thanks to excitement over a possible spot Bitcoin ETF (exchange-traded fund).

According to ARK daily trading data viewed by Cointelegraph, ARK’s Next Generation Internet ETF (ARKW) sold 36,168 GBTC shares on November 22, for a total of 697,768 GBTC downloads since October 23.

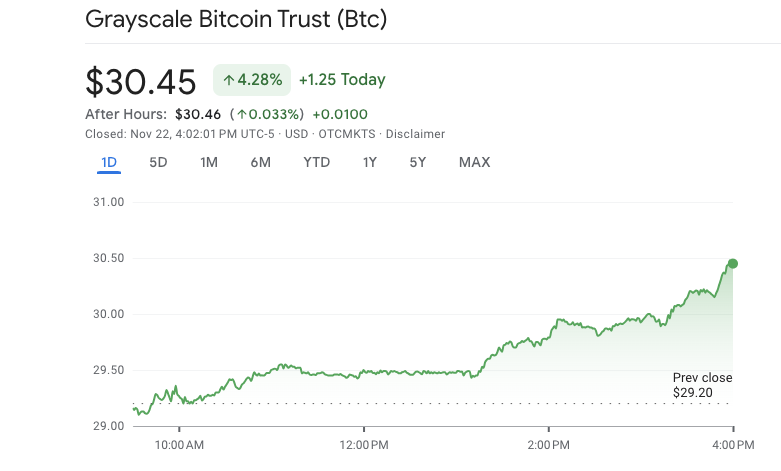

Second Google FinanceOn November 22, ARKW dropped nearly $1 million worth of GBTC as the Grayscale trust traded around $30 and then closed at $30.50. On November 23, US markets were closed for Thanksgiving.

ARC Grayscale started selling shares of Bitcoin Trust On October 23, 2023, Bitcoin was heading towards $34,000. Prior to this, the first GBTC transaction reported by ARK occurred in November 2022. Sold 450,272 GBTC shares.

Related: Grayscale meets with SEC to discuss details of spot Bitcoin ETF

After selling nearly 700,000 GBTC shares last month, ARKW still owns $131.8 million worth of GBTC shares, or more than 4.3 million GBTC shares. Second According to ARKW’s official data, as of November 24, Grayscale Bitcoin Trust represents 9.2% of ARKW’s portfolio, ranking third after Coinbase and Roku.

Second data The ARK ETF, which unloads funds from Google Finance, is up more than 68% year to date compared to +271% recorded by the Grayscale fund.

Meanwhile, Bitcoin is up 125% since the beginning of the year, approaching $38,000 on November 16, the highest level since May 2022. Cointelegraph Markets Pro.

Learn more from Helen Partz.