Bitcoin miner is safe from recent dips

According to a market report by Bitfinex, Bitcoin mining companies (bitcoin) adopts risk-taking strategies by dumping BTC on exchanges.

The cryptocurrency trading platform’s latest newsletter takes a comprehensive look at the Bitcoin mining industry, highlighting the recent surge in miners dealing with large-volume BTC sales. This led to a corresponding increase in the share value of Bitcoin mining companies, thanks to increased institutional interest in BTC throughout the year.

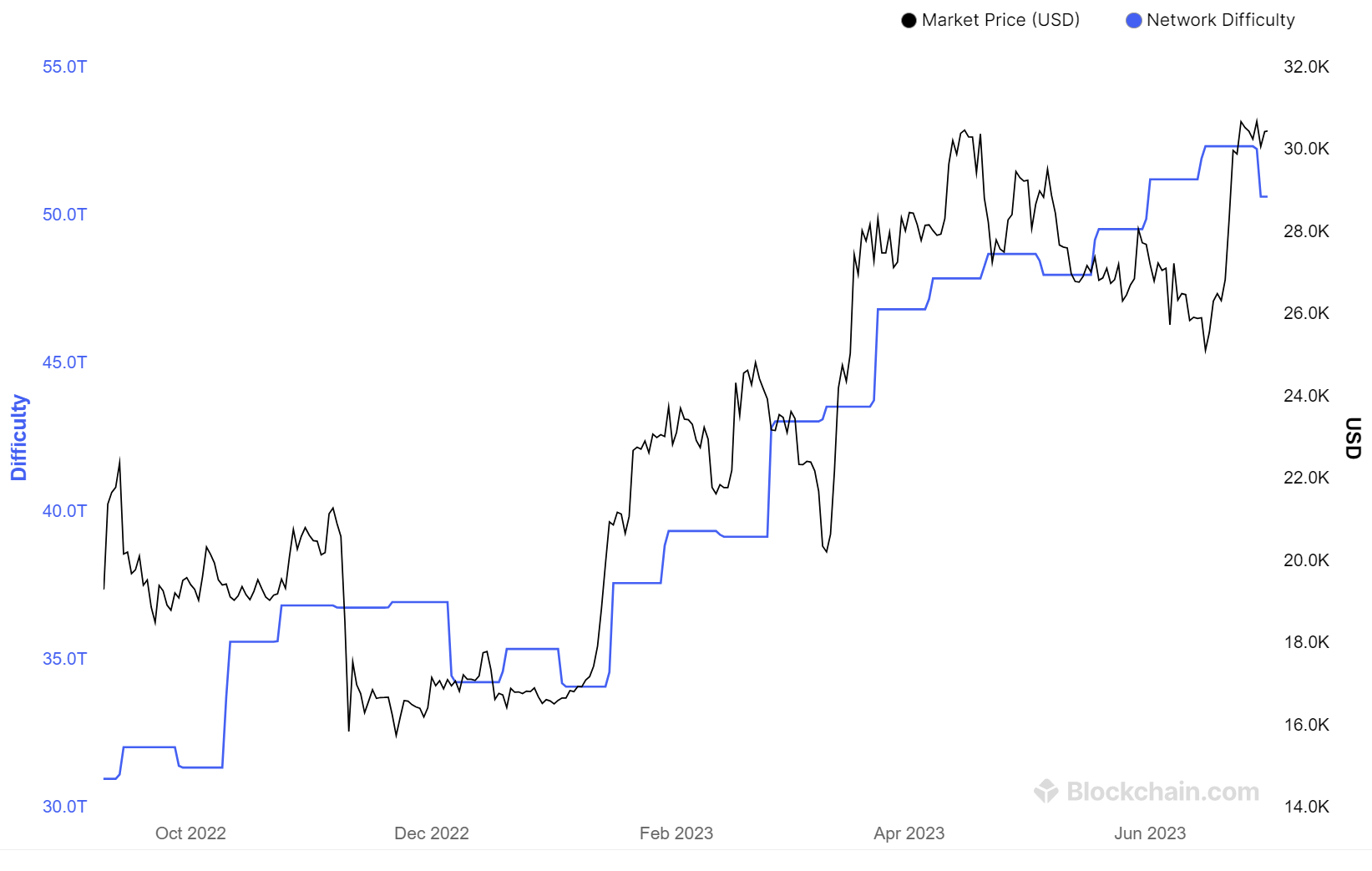

The report highlights how Poolin has reached the highest number of BTC sold in the market in recent weeks. Bitfinex analysts also highlight that Bitcoin mining difficulty has recently reached an all-time high, labeling it as an indicator of “miner strength and confidence”. The report states:

“Bitcoin miners are clearly on the rise in allocating more resources to assets, which increases mining difficulty, but they hold their positions, resulting in more Bitcoin being sent to exchanges.”

The report suggests that miners maintain positions on derivatives exchanges, with a 30-day cumulative volume of 70,000 BTC transferred in the first week of July 2023.

While miners have historically moved BTC to exchanges using derivatives as a hedge for large spot positions, the report describes the high volumes as unusual:

“A move to exchanges of this magnitude is extremely rare and potentially represents a novel approach by miners.”

Bitfinex also cited data from Glassnode which states that Poolin was responsible for most of this operation as the mining pool dumped BTC onto Binance.

Analysts point out that there may be several plausible reasons behind the recent mining stance. may be among these Fund transfer through exchanges for hedging activities in the derivatives market, execution of over-the-counter orders or for other reasons.

The increase in mining difficulty also indicates the addition of new mining power to the Bitcoin network. According to analysts, this is a sign of growth in the prosperity of the network and growing confidence in the profitability of mining activity.Thanks to the increase in BTC prices or the improvement of the hardware used.

“Therefore, miners find themselves in a unique situation where they rapidly increase their mining potential as the Bitcoin halving approaches, while also protecting their risk more carefully than in previous cycles.”

Finally, the report suggests that Bitcoin’s on-chain movements reflect a shift in supply from long-term to short-term holders. This type of investor behavior is often seen in bull market conditions, as new entrants seek quick profits while long-term holders take advantage of increased prices.

Cointelegraph reached out to several companies and mining pools last month to investigate why Bitcoin miners’ output has increased. As recently reported, By the end of June, miners had sent over $128 million in revenue to exchanges..

Translation of Walter Rizzo