Bitcoin Halving Will Increase “Efficient” Mining Costs to $30,000

Although Bitcoin Ordinals (Bitcoin) supports miners’ profits, new research warns that a situation of “economic stress” is ahead.

In the latest issue of the weekly newsletter of the analytics company “The Week On-Chain” glass knot predicts new critical problems for miners after the upcoming halving grants For Bitcoin blocks.

Impact of Bitcoin halving could be ‘onerous’ for miners

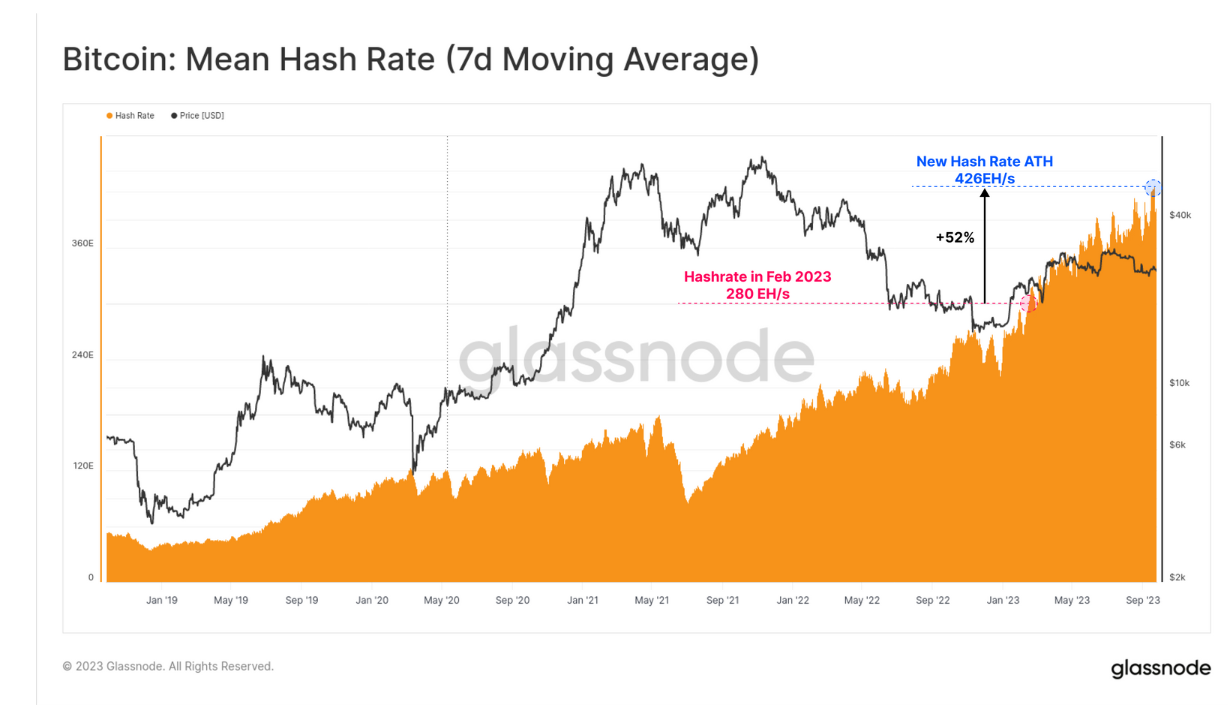

Competition among Bitcoin miners is exploding with the hash rate (an estimate of the combined processing power distributed across the blockchain) reaching an all-time high.

For Glassnode, this represents unprecedented conditions for miners trying to make a living at BTC’s current price levels.

Sequential inscriptions contribute to this phenomenon by acting as “fillers”, turns empty spaces of blocks into a source of income for miners.

“Of course, as the demand for block space increases, miners’ income will also be positively affected.”is read.

The percentage of revenue from fees is up between 1% and 4% from the lows seen in Bitcoin bear markets, but is still modest by historical standards.

“Meanwhile, the amount of hash rate competing for these rewards has increased by 50% since February as more miners and new ASIC hardware are installed and connected.”points out “The Week in the Chain.”

This hash rate increase paves the way for an upcoming showdown. Miner rewards per block will decrease by 50% in April 2024, Doubling of the so-called “production cost” per BTC. It is currently around $15,000, but will later exceed $30,000: a value above the current spot price.

Glassnode introduced two models to predict the price at which miners will generally fall into the red; the first compared emissions to mining difficulty.

“With this model we estimate that the most productive miners on the network have a mining price of approximately $15,100”researchers point out.

“However, the purple curve shows that this level will ‘double’ to $30,200 after the halving, which will likely put the majority of the mining market under severe economic stress.”

According to a previous model, miners’ average purchase price was $24,300 per Bitcoin; which was about 8% lower than its current value.

Incentives for BTC price

Some are more optimistic about how miners will handle the halving preparation phase.

Related: Bitcoin Trading Volumes Reach 5-Year Low as Fed Encourages HODL

Analyst Filbfilb, co-founder of the DecenTrader trading suite, reiterated this in an interview with Cointelegraph this month: miners will increase BTC accumulation before the event.

“Miners will be incentivized to ensure prices are well above marginal cost before the halving.”he stated in a statement thread on X (formerly Twitter) in August.

“Whether they knowingly or unknowingly collude, they are collectively incentivized to raise prices before their marginal revenues are effectively halved.”

Underpinning the dynamics of BTC supply will be what Filbfilb describes as “buying the rumors” about the halving and its impact on the amount of BTC minted.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research before making a decision.

Translation by Walter Rizzo