BIS develops regulatory framework to counter cyberattacks against CBDCs

on July 7, Bank for International Settlements (BIS), a financial institution controlled by its component central banks, published a regulatory framework for defend central bank digital currencies (CBDC) potential cybersecurity threats.. BIS wrote:

“Recent examples of smart contract hacking in DeFi that have resulted in significant loss of money are an indication of the potential security risks CBDC systems may face.”

BIS report says security frameworks must provide protection confidentiality, integrity And Accessibility of CBDC transactions. By design, CBDCs should be able to: Scale dynamically to respond to spikes in transaction volumesthey should not have single points of failure, they should work 24/7uninterrupted and should still work reference financial institution is experiencing downtime. Besides:

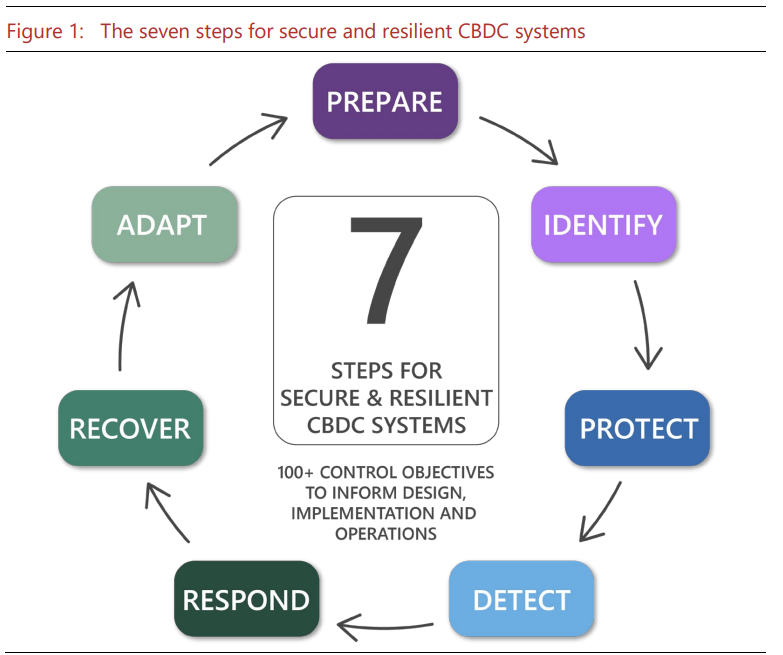

“This framework for regulating targets set and adapted to CBDC systems […] It has seven stages: Prepare, Define, Protect, Detect, Respond, Recover and Adapt”.

Together, seven stages result in 104 control variableslike “24/7 monitoring and alarm function”, “due diligence” about the security of cryptographic keys And “using a DDoS protection service” to lighten the volume of network traffic. For the implementation of the regulatory framework, the BIS required the establishment of a central bank leadership and board, a security officer and various teams dealing with information technology, security and stakeholders.

While cautious about decentralized finance, the BIS has strongly supported the adoption of CBDCs. On June 20, the financial institution was released unified ledger proposal For cross-border transactions And tokenized assets. BIS in April, bank of england.

Translation of Matteo Carrone