IMF working paper proposes a risk assessment matrix on cryptocurrencies at the national level

A working paper published by the International Monetary Fund (IMF) suggests a number of vulnerabilities and potential policy responses for the cryptocurrency sector.

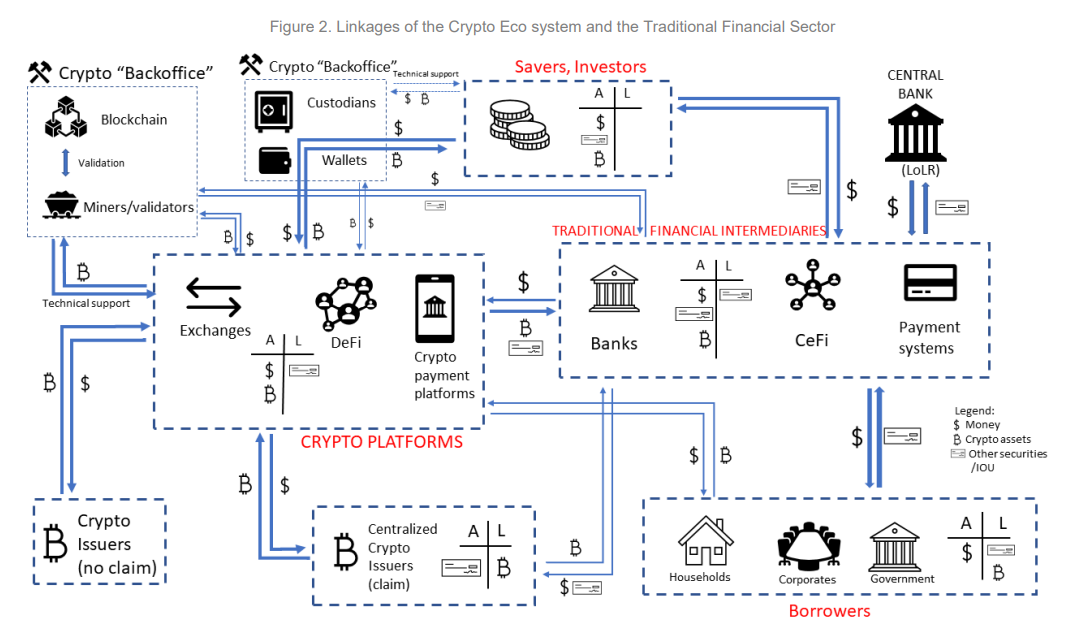

IMF on September 29 published A working paper titled “Assessing Macrofinancial Risks from Crypto Assets.” In the article, authors Burcu Hacibedel and Hector Perez-Saiz proposed a crypto risk assessment matrix (C-RAM) that would allow countries to identify indicators and triggers of potential risks in the sector. The matrix also aims to summarize regulators’ potential responses to risks they may identify.

The matrix includes a three-step approach. The first stage involves using a decision tree. Assessing the macrocriticality or impact potential of cryptocurrencies on the macroeconomy. The next step involves examining indicators comparable to those used to monitor the traditional financial sector. The last stage is related to global macrofinancial risks that affect countries’ systemic risk assessment.

For example, the authors applied C-RAM to identify risks in El Salvador, the country that produces Bitcoin (Bitcoin) legal tender currency a September 2021. According to the document, El Salvador’s use of BTC brings market, liquidity and regulatory risks. The authors write:

“The use of cryptocurrencies in El Salvador can also be considered macrocritical, as recent regulatory and legal changes pose significant risks of crypto liberalization in the country, undermining financial stability and affecting large remittances and other capital inflows.”

The IMF has always blocked El Salvador from adopting Bitcoin. In January 2022, IMF urges Central American country to give up Bitcoin’s legal currency status. According to the IMF, the use of BTC as legal tender poses “major risks” in areas such as financial stability, financial integrity and consumer protection.

Related: International Monetary Fund introduces new platform for cross-border payments based on CBDC, crypto community reacts: “No one wants this”

As cryptocurrencies evolve rapidly, regulators are playing hide and seek to implement responses to the potential risks of this emerging sector. On September 7, at the request of India’s G20 Presidency, the IMF and the Financial Stability Board collaborated on a joint document containing policy recommendations. The document combines established standards and recommendations for various risks associated with cryptocurrency activities.

Translation by Walter Rizzo