Ethereum OFAC Compliance Rate Dropped to 45% After Merger Update

The historical Merge update took place last September 2022. Ethereum migration from proof of work (PoW) to proof of stake (PoS) consensus protocol General decline in compliance with standards set by the Office of Foreign Assets Control (OFAC).

Ethereum blocks subject to OFAC compliance negatively impact the neutrality of the Ethereum ecosystem by censoring some transactions. In early August 2022, OFAC approved Tornado Cash and several Ether addresses (ETH) is associated with it due to its ability to hide and anonymize transactions.

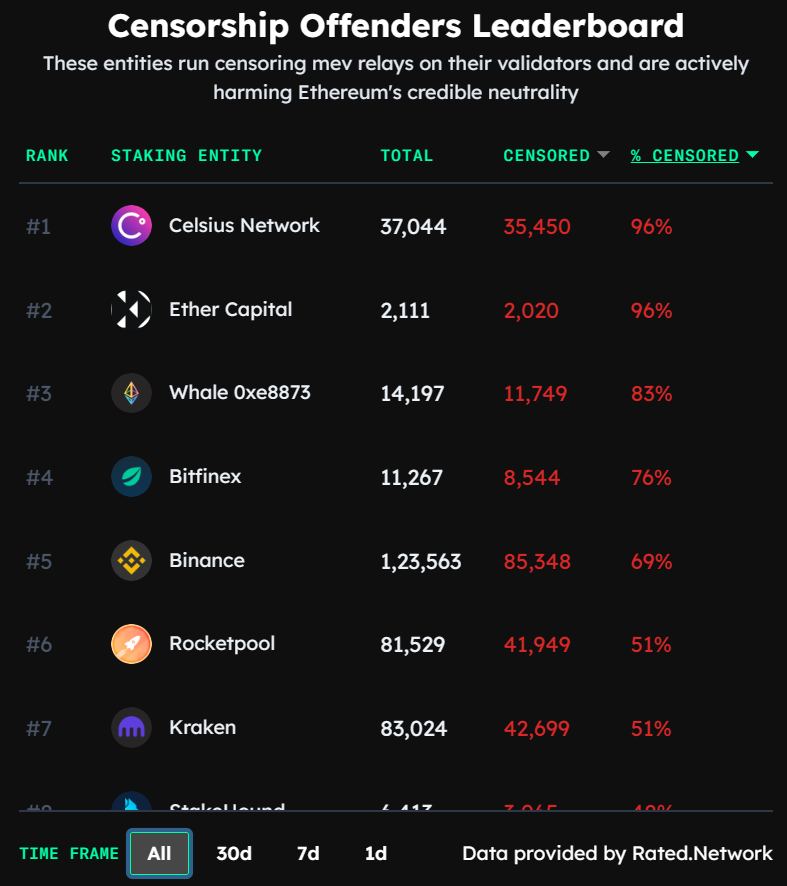

Prior to the merge update, Ethereum’s compliance with OFAC increased exponentially as organizations such as cryptocurrency exchanges chose to censor MEV-Boost relays in their validators. The list of major operators that impose censorship is filled by popular platforms such as Binance, Celsius Network, Bitfinex, Ledger Live, Huobi (HTX) and Coinbase. MEV Watch.

However, the overall OFAC compliance of Ethereum blocks has decreased significantly. As of November 2022, 78% of Ethereum’s total blocks were compliant with OFAC regulations. As of today, September 27th Ethereum OFAC Compliance Dropped to 30%An overall reduction of 57% was noted.

To combat OFAC compliance, operators must use relays that do not impose censorship within compliance requirements. There are seven main commonly used MEV retrofit relays: Flashbots, BloXroute Max Profit, BloXroute Ethical, BloXroute Regulated, BlockNative, Manifold, and Eden. However, according to MEV Watch, not all systems are OFAC compliant:

“Only 3 of the 7 existing major relays do not censor according to OFAC compliance requirements.”

It is also important to note that not all blocks created by OFAC-compliant relays censor; however, any blocks made by OFAC-compliant relays will be censored when non-compliant transactions are broadcast to the network.

Although OFAC regulations primarily affect organizations based in the United States, Validators outside the US should consider running uncensored transmissions for the benefit of the network.

After Ethereum reduced OFAC compliance, Grayscale decided to waive all rights to Ethereum PoW tokens (ETHPoW). Despite this, the decision was attributed to the lack of liquidity in the market. According to the official announcement:

“As a result, the rights to purchase and sell ETHPoW tokens cannot be exercised and Grayscale, on behalf of its record-date shareholders, waives its rights to these assets.”

At the same time, some cryptocurrency investment firms such as ETC Group are also trying to launch cryptocurrency. exchange traded products (ETP) dedicated EthereumPoW.

Translation by Walter Rizzo