Tether authorizes $1 billion USDT to “stockpile” the Tron network

Accounts tracking blockchains for major mints, exchanges, and token transfers reported $1 billion worth of USDT was authorized to the Tether Treasury (USDT), aims to provide short-term USDT liquidity to the Tron network.

Blockchain tracker WhaleAlert pointed out a $1 billion vulnerability in the Tron network.

Ardoino added that this is not a real issue, but rather authorization. The allocated amount will serve as inventory for the next emission requests and on-chain swaps of the Tron network.

PSA: Rebuilding USDT Billion Dollar Inventory on Tron Network. Please note that this is an authorized but unregulated transaction, meaning this amount will be used as inventory for the next period’s issuance requests and chain swaps.

PSA: 1 billion USDt stock boost on Tron Network. Note that this is an authorized but unregulated transaction, meaning this amount will be used as inventory for future issuance requests and chain swaps.https://t.co/Y1bqxZglgR

— Paolo Ardoino (@paoloardoino) September 19, 2023

According to Tether’s official FAQ page, “permitted but unissued” USDT Required to guarantee the token creation and issuance process:

“By creating “authorized but unissued” USDT, Tether limits the number of times Tether signers need to access private authorization keys, thus reducing their exposure to security threats.”

Allowing USDT into the Tether treasury allows the company to issue USDT instantly upon receiving customer funds, ensuring that the issuer maintains 100% of its reserves.

As previously reported CointelegraphUSDT tokens issued on the Tron blockchain reached all-time highs in 2023. The network has 42.8 billion USDT in circulation. While the Ethereum blockchain has approximately 39 billion USDT in circulation on-chain.

Tether’s CTO recently reported on similarly significant USDT clearances reported by blockchain followers, such as the $1 billion USDT mint to support Ethereum chain swaps held in June 2023.

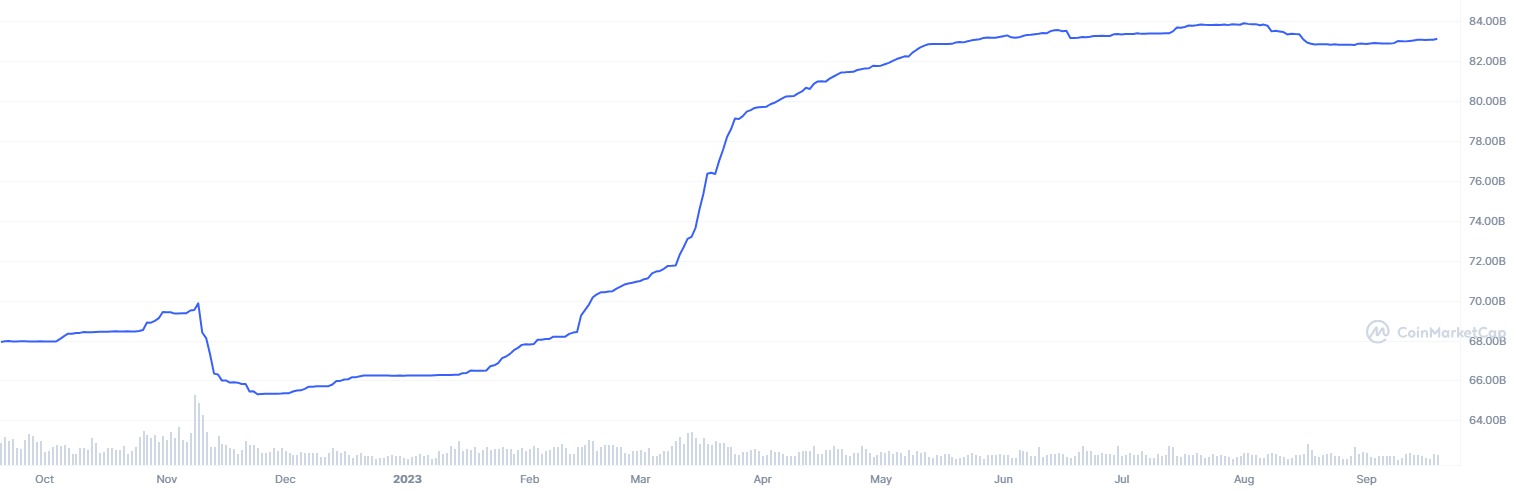

Tether has seen its market cap surpass $83 billion in 2023 after minting nearly $16 billion in USDT since January. USDT remains the leading stablecoin pegged to the US dollar in terms of market cap.

In comparison, Circle’s USDC stablecoin (US Dollar) has seen its market cap fall from $50 billion at the beginning of 2023 to $26 billion at the time of publication.

The collapse of Silicon Valley Bank (SVB) is believed to have contributed to the decline in USDC’s market value; At the time of the collapse in March 2023, Circle had $3.3 billion tied up in the institution.

Translation by Walter Rizzo