Blockchain integration “more reasonable” than merging CBDCs

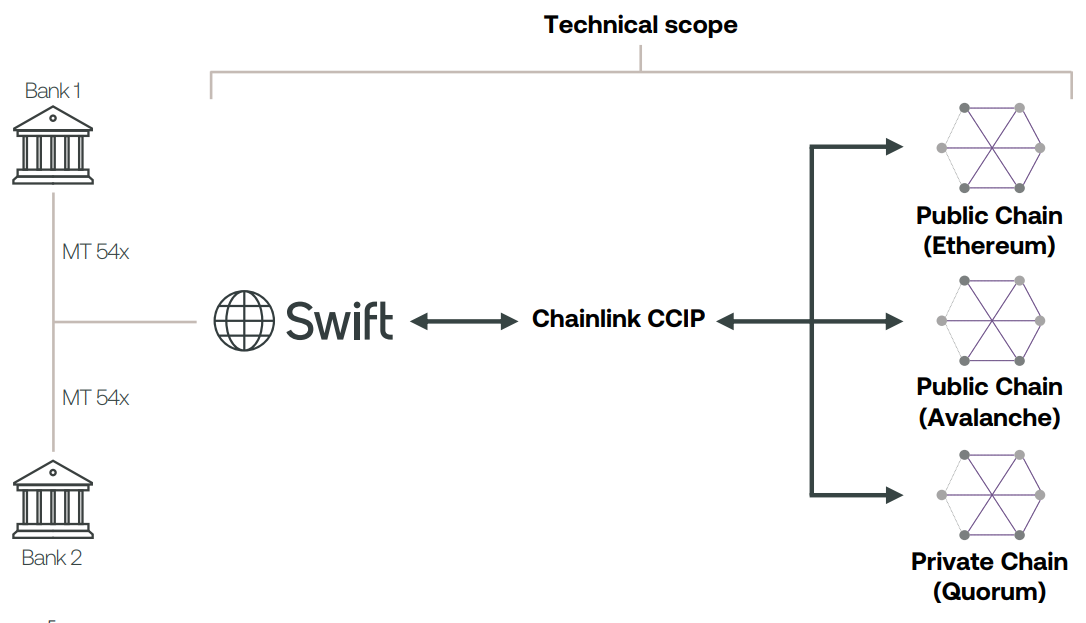

A recent report shared by banking communication network Swift highlights how it can connect to various blockchains and solve the problem of interoperability between different networks.

In the report, “Connecting blockchains: overcoming fragmentation in tokenized assets,” Swift concludes: more phased approach Its ability to connect existing systems to blockchains is “more plausible” in terms of market development in the near term than combining digital currencies issued by central banks (CBDC), deposits and tokenized assets in one unified ledger.

Swift highlighted the “lack of secure interoperability” between different blockchain networks in the report. The finance giant claims it requires various inefficiencies and poor user interaction. But the financial giant believes Swift has the potential to solve the interoperability problem.

Working with various financial institutions and blockchain network provider oracle Chain LinksSwift said it was able to demonstrate its ability to provide a single point of access to multiple networks using existing infrastructure. According to Swift this Significantly reduces the operational challenges and costs that institutions face to support tokenized assets.

Tom Zschach, Swift’s chief innovation officer, said in a press release that tokenization can reach its full potential by connecting institutions to the entire financial ecosystem. Zschach showed that:

“Our testing clearly demonstrates that the current secure and reliable Swift infrastructure can provide the central port, removing a major hurdle in tokenization development and unlocking its potential.”

In the report, Swift highlighted the many potential benefits of tokenization, including increased liquidity and automation, as well as increased transparency and security.

In addition, Banking Infrastructure points out that there are benefits to tokenization. it also presents significant obstaclesLike the legal and regulatory frameworks that are currently being developed. According to Swift, this remains a challenge for institutions dealing with tokenized asset transactions.

Translation of Walter Rizzo