Buyers now control 16% of supply in 2020 bull market

In the last three years Bitcoin (Bitcoin), given investors’ stubbornness in not wanting to sell, has given rise to a new generation of hodlers.

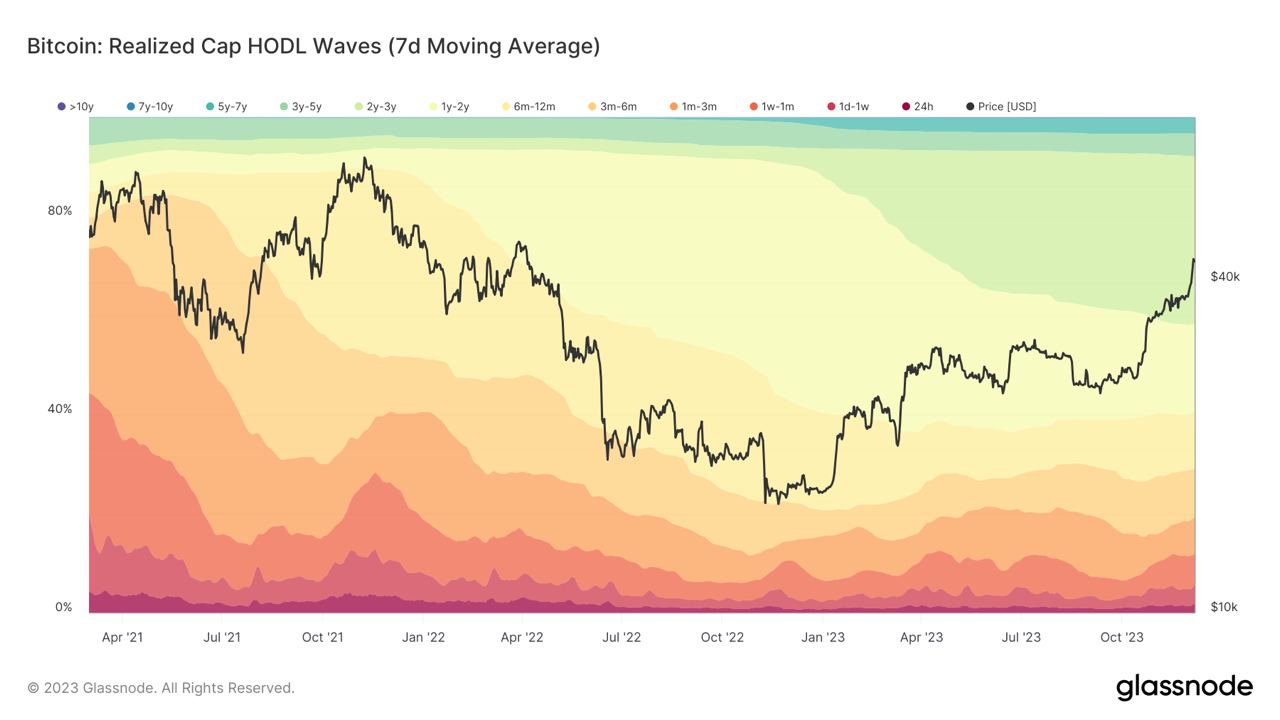

Data of popular parameter HODL Waves It shows that those who bought Bitcoin towards the end of 2020 still have their money.

BTC price will need to rise “a lot” for hodlers to decide to sell

Bitcoin’s long-term investor group, also known as LTH (long-term holders), has no plans to reduce their risk despite the bull run in 2023.

By grouping BTC supply by the amount of time since each coin’s last movement, HODL Waves highlights a specific age category that has seen notable growth over the past year.

Since the bear market reached an all-time low in late 2022, cryptocurrencies that had not moved for two to three years have significantly increased their presence in the overall supply. Last December the group accounted for about 8% of supply; currently its share exceeds 15 percent.

So those who purchased BTC between December 2020 and December 2021 resisted the urge to take profits en masse.

Realized upper HODL Waves, which show the weighted relative value of coin classes, also reveal the larger gain in percentage of total realized capitalization coming from two- or three-year-old coins.

However, BTC/USD is up 165% since the beginning of the year, as data confirms Cointelegraph Markets Pro And Trading ViewThis makes the hodlers’ durability remarkable.

Philip Swift, creator of the Bitcoin statistical resource Look Into, a portal offering HODL Waves, often comments on the LTH phenomenon because it is clear that over time experienced investors are increasingly settling into their positions.

“Bitcoin’s 1-year HODL wave has barely progressed so far,” he said guess on X (formerly Twitter) last month.

“Long-term Bitcoin investors are not looking to sell their money until we get MUCH higher.”

Speculators counterattack

The group that opposes LTHs (short holders (STHs) or speculators) instead increased profit taking last week.

Related: Bitcoin Rises 170% Since ECB Declared Its “Last Breath” at $16,400

As Cointelegraph reported, Bitcoin’s move past $40,000 triggered a sudden selling reaction from these operators, who sold $4.5 billion worth of Bitcoin in a matter of days.

In an environment where LTHs already control more supply than ever before, the impact on spot markets was minimal.

According to data from on-chain analysis company glass knotAs of December 6, this figure stood at 14.92 million BTC, slightly below the all-time high of 14.95 million, or 76.3% of the supply, recorded on November 28.

This article does not contain investment advice or recommendations. Every investment and trading transaction involves risk, and readers should conduct their own research before making a decision.

Translation by Walter Rizzo