SBF found guilty on all charges as FTX’s loans rise to 57%

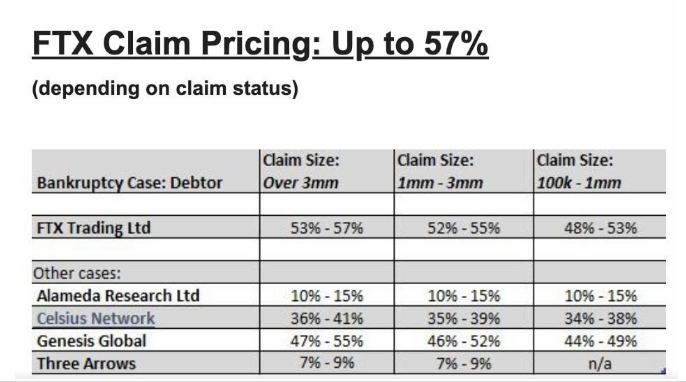

According to Claims Market data, current prices of FTX loans have reached a high of 57%. The price increase is attributed to the valuation of artificial intelligence (AI) companies in which the bankrupt crypto exchange had previously invested.

creditors “point” When companies get into financial trouble or go bankrupt, they seek to recover some of their investments. Investors often trade these loans based on estimates of the total amount recovered. When the price of a loan increases, the estimated recovery value also increases.

As the value of FTX’s investment in these AI companies increased, so did the potential amount to be recovered from bankruptcy cases. A claim is a legal demand for a specific monetary amount.

The credit percentage value refers to the percentage of the deposited amount that is expected to be recovered from the platform. The value of FTX’s receivables has risen to first place compared to other failed crypto companies, with Celsius at 35-40%, Genesis at around 50%, Alameda at 10%, and Three Arrows Capital at just 7-9%.

Related: SBF secretly says ‘To hell with the regulators’

The increase in FTX’s allegations also comes as the public trial of FTX’s former CEO Sam Bankman-Fried ended on November 2, with a jury finding him guilty on all seven charges. The judge will announce the sentence in March 2024.

FTX’s claims became a major point of contention for the crypto community during bankruptcy proceedings. Previously, the judge allowed FTX to sell on the market Nearly $3.4 billion in crypto assets to compensate creditors. With the rising price of cryptocurrencies and the increasing valuation of companies in which FTX invests, creditors have a good chance of recovering a significant portion of the lost money.